Sometimes, credit card issuers do something nice for us and leave us asking why did my credit limit increase?

Your credit limit is the max you can charge to a credit card before paying it down. The sum of all your credit limits makes up your available credit. Now, let’s learn why automatic credit limit increases happen.

Key Takeaways

- Credit card companies grant an automatic credit limit increase to reward those with responsible credit habits or those who progress on a built-in path card. However, an increase can promote cardholder overspending, leading to card issuers profiting on interest on outstanding balances.

- You can manually request a credit limit increase, but your request will incur a hard pull on your credit report and temporarily decrease your score.

- A history of good credit use makes acquiring loans or credit in the future – cheaper. Good credit pays you back through better loan terms and lower interest rates.

Credit Limit Increases

The Why

Each credit card issuer has its methodology to determine if a cardholder can be granted an automatic credit limit increase. Usually, the creditor wants to see that a cardholder handles credit responsibly and has used their existing credit line well. They look at your credit history for a healthy track record of making on-time payments and low credit utilization. They will automatically increase your credit limit if they see both indicators. Congrats!

There are other factors behind the process too.

Customer Retention – Many credit card issuers use limit increases to retain their customers in good standing. Currently, the credit card market is highly competitive and saturated with tons of rewards cards vying for cardholder attention and dollars. To keep your customers’ loyalty and retain your best ones, it’s good to reward them for their great track records.

Making More Money – If your card issuer notices you’ve earned a raise, then you’re game to earn a raise in credit as well. For instance, Chase bank would ask if I had an increase in income to get a potential increase in my credit limits. It was a helpful feature as I got the increase for my Chase cards, and I ended up with a higher credit score.

Built-in Path – Some cards provide built-in pathways to increase your available credit, given you meet specific criteria. Sometimes a credit card company will outline these terms on the card application. It is common for cards targeted at people with scores in the middle ranges.

Making More from APR – But it’s not always for a good reason. Credit card companies use limit increases to incentivize users to spend more and develop credit card debt. Then, the issuers can make bank on APR interest charges. We cover the downsides of increased credit lines further on.

The How

You can become eligible for an automatic limit increase as soon as six months after you first open your card account, with periodic reviews afterward. The card issuer will start their review by doing a soft pull for your credit report. They will look at these categories with a specific emphasis:

- Credit history – track record of on-time payments and any outstanding balances

- Credit utilization ratio (aka credit usage) – % of credit used out of total credit limit

- Keeping this figure under 30% is considered good, but creditors see a figure below 10% as excellent. Thinking about it, it’s weird that you need to demonstrate that you use very little credit to get more of it. A lower utilization is better for your score in the long term.

- Credit score – overall credit score that signifies your ability to handle credit. Scores are bucketed into ranges. Each score range rates one’s creditworthiness and affects one’s ability to apply for loans or credit cards. For instance, Good credit is usually 700 – 749, while anything above it is Very Good or Excellent. A person with a 750 will get lower interest rates/APR on a loan/credit card, better terms, and a higher credit limit than someone with a 650. If you’d like to boost your credit score – look no further.

Credit Utilization Ratio & Credit History Matter

Credit history and credit utilization make up 65% of your total score but are the main factors that highlight your ability to handle credit responsibly. It’s these factors that your credit card issuer looks at to determine if you qualify for an automatic increase and by how much. Once your card issuer reviews these factors and runs them through their internal process, they will qualify you for a limit increase. If they grant one, they will decide how much – which will be viewable on your following statement and credit report.

We recommend checking your credit report at least once a month via a free service like Credit Karma or AnnualCreditReport.com to view your score, its trends, and each part of your score to ensure it accurately reflects your records. Plus, these websites will list your reported lines of credit, show tips to improve your score, and advertise credit card offers that could help you get a better credit card. Keep in mind that these sites make money from ads and suggest other financial products to you, like personal loans.

Using your credit card responsibly to build your credit is a major part of your personal finance journey. Making sound financial decisions today puts you in a better position for future milestones.

Requesting a Credit Limit Increase

You can also request a credit limit increase. It’s common to do this if you are earning more money or want to increase your amount of available credit before a large purchase.

If you request an increase, your creditor may perform a hard pull to look at your latest credit report. They can only do the hard pull with your permission as it causes a temporary dip of a few points on your credit score. Each hard pull affects your record for one year and disappears after two years. We recommend thinking through when to ask for one and how many you request at one time.

Having too many hard inquiries within a short period can lower your score and put you at a disadvantage if you seek to open a new credit card or take out a mortgage or other loan. And having too many hard inquiries on file can balance out the score gain from an increased credit limit. In contrast, a limit increase review will use a soft pull which does not impact your score.

Thus, requesting a credit limit increase request can hurt your credit score.

When I was an Uber cardholder, the card issuer was Barclays. I made several requests to increase my available credit with them, which was only $500.

Despite earning a raise and having a solid credit history, Barclays denied my requests and only left me with a hard inquiry on my credit report. After I opened new cards, I closed my Uber card.

Later on, I realized that Barclays may have denied me an increase so I would spend over my limit, and they could charge me penalty fees. In contrast, my other rewards card started me off with 10x the credit limit and granted me a higher limit whenever I earned a raise.

The Benefits

Now let’s dive into the good stuff …

There are several benefits from a limit increase, including

Improved Credit Utilization

Increasing your available credit means you spend less as a percentage of your available credit – lowering your credit utilization ratio. As this ratio makes up 30% of your overall score, it is helpful to keep your utilization low. You get the most benefit from this metric if you keep your spending the same while your credit line goes up. For example, Chase granted me a credit line increase on several of my cards. As I kept my spending the same, I walked away with a higher credit score.

More Purchasing Power

If you have large purchases coming up, a higher credit limit adds to your buying power. The more you use your rewards card, the more you earn – provided you match the card to your spending. Make sure you have enough funds to pay off your bill statement and avoid building debt.

Better Credit Card or Loan Terms in the Future

It pays to have credit today to get it cheaper tomorrow. In the future, if I open a new card or take out a loan or mortgage, I will qualify for better credit terms and lower interest rates thanks to my established track record. Having history to show you are a responsible borrower will pay you back in the future through the best loan terms and interest rates.

No Record of a Soft Pull

An auto increase uses a soft inquiry, so it won’t negatively impact your credit score. Also, you will not be notified about the inquiry. If your creditor increases your line, you will get the boost.

The Costs

With great financial power, comes great financial responsibility.

A higher credit limit means more spending power. But…

The biggest drawback is the temptation to spend beyond your budget and above your means. High spending can quickly eradicate your credit score gains. Even with a higher credit limit, your credit score receives the max benefits if you keep your spending the same. Your credit utilization ratio will go down, you look responsible, and your score gets a bump.

Peril of the Credit Card Industry Business Model

According to a Motley Fool analysis, credit card issuers made $176 billion in 2020. They also highlighted:

- 43% of that income or $76 billion is from interest payments cardholders paid on their revolving balances

- Penalty fees for late payments accounted for $12 billion

- Total income from interest and penalty charges amount to $88 billion or 50% of the industry’s total income

The industry’s business model thrives off customers who don’t regularly pay off their balances. Good credit habits keep more money in your hands and away from your credit card company’s bottom line.

If you spend more than you’d like to, consider practices to make it more challenging to use your card, like putting it in your drawer or taking it off Apple Pay. If you spend more than you can pay back, the penalties from carrying a balance will hurt your wallet and credit score more than any benefit from an increase. In addition, a high APR will tack on interest and fee charges that can snowball over time.

As a last resort, you can contact your card issuer and ask them

- For your permission before increasing your credit limit in the future

- To reset your credit limit to the prior amount

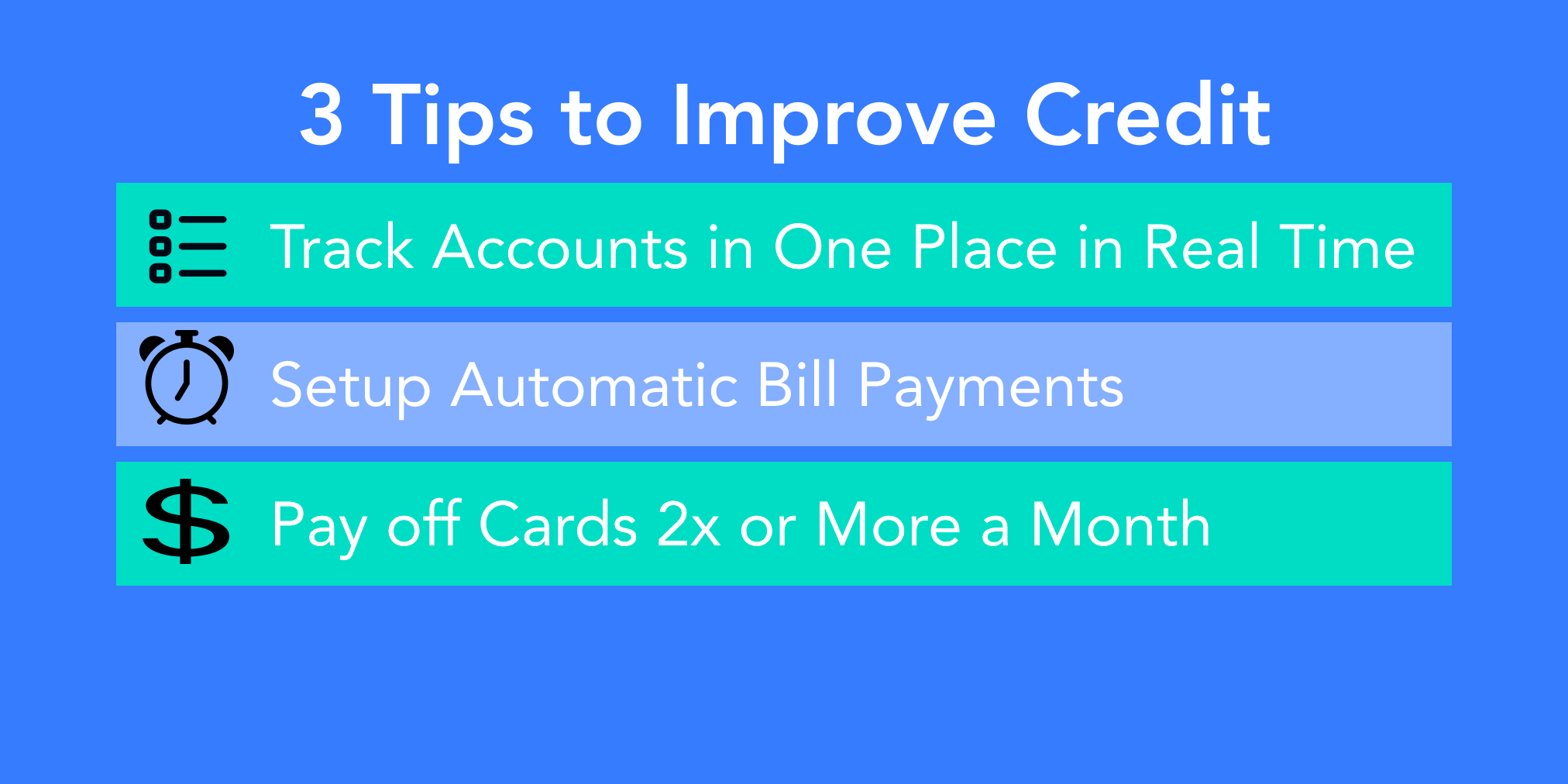

Quick Tips to Improve Credit Score

Here are a few ways to improve your score to get a credit limit boost.

1. Track Your Accounts in Real-Time in One Place

Use a service like Mint to monitor your financial life in one place. Plugin your credit cards and bank accounts to track outstanding balances, purchases, and payment patterns in real-time. It’s great to view and understand your financial position on one dashboard.

2. Setup Automatic Bill Payments

Set up automatic, routine payments for each of your credit cards around the posting date of each card’s billing statement. This way no bill will be left unpaid.

3. Pay Off Cards 2x or More a Month

Pay off your cards twice a month or more. Making payments often is a great way to keep your balances low. When your banks report to the credit bureaus, your utilization levels look consistently low, which could hasten the improvement of your score. Add in the bill payment dates as repeating events in your calendar.

The Bottom Line

Overall, getting an automatic credit limit increase depends on your usage habits and your card issuer’s timetable and criteria. These companies grant an increase to reward their cardholders and to boost the likelihood of overspending. Developing responsible credit habits betters your odds of a limit increase while maxing your card rewards from your cards. Having a higher credit limit today grows your purchasing power and makes obtaining credit in the future a cheaper endeavor.

Don’t forget to find the right rewards cards to get all the cash back and points you can!