Getting the most of your money is the foundation of personal finance. There’s a lot to be gained by learning how to take full advantage of your paycheck. Let’s dive into what is pre-tax income and learn how to make those dollars work for you.

What is Pre-Tax Income?

It’s the total amount of money your employer pays you before you receive your paycheck. Your pre-tax pay is just that — your pay before taxes and other deductions, also known as gross pay. When you recruit for jobs, they always quote the pre-tax salary or wage rate.

You are taxed on your taxable income, which accounts for your deductions- which we’ll cover in more detail below, including how to best take advantage of them.

Post-Tax Income

Your after-tax pay or net income is your pay after subtracting taxes and deductions. It’s the pay you take home and use as the basis for financial planning and living life. Some financial advisors suggest using your pre-tax income as the basis for financial planning, but it won’t lead to accurate figures.

Your employer withholds your taxes and deductions on your behalf, in accordance with federal law. Though sometimes, it feels like this is what really happens to your money…

But that’s not the case…let’s talk about taxes and how deductions can work for you.

Tax Rates

You are taxed on your taxable income, which accounts for your deductions.

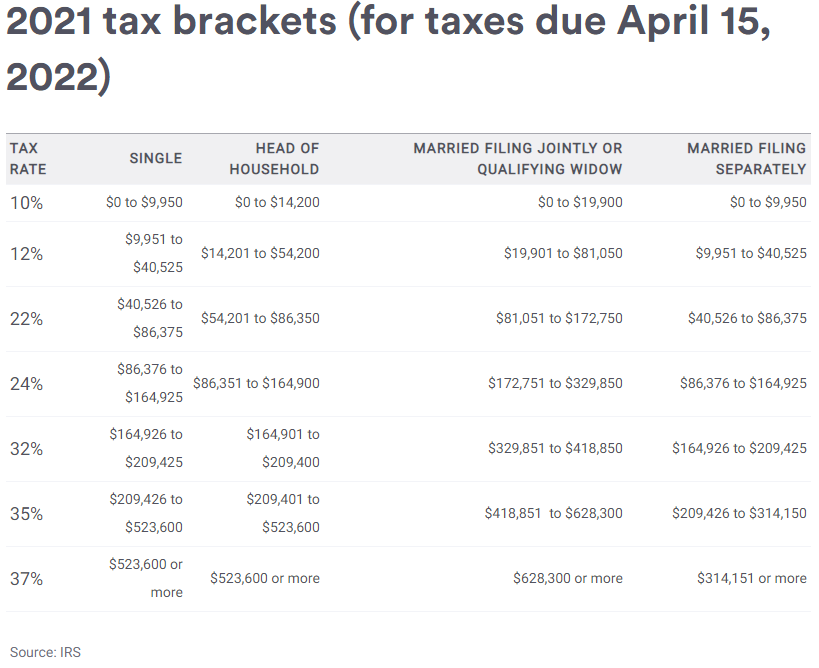

Taxes are a fact of life and are used to fund our society’s services, such as road maintenance and waste disposal. Most countries use a progressive tax scale where how much you pay depends on how much you make and if you file single or married. This is the federal income tax schedule for 2021, where you pay more for each successive bracket.

You pay taxes on the income that falls within each tax bracket. So you pay 10% tax ($995) on the first $9,950 you make if you are a single filer.

The average American household makes about $50,000 a year in gross pay. Let’s assume you make $50,000 this year and are a single filer — this is what your taxes will look like.

And this is what it comes out to be.

Your total federal tax bill is $6,748, which comes out to be about 13.5% of your gross pay. This figure is also your effective tax rate as it’s the percentage of your income applied to taxes. Your marginal tax rate is the rate of the highest tax bracket your income applies to. For every extra $1 you earn, you pay 22 cents in federal income tax. This figure will play into deductions later.

So you are not taxed at the highest bracket for all your income, but rather different rates apply for different ranges. These rates change each year and can be found here.

Other taxes include Social Security, FICA, and your state taxes. State tax rates vary but note that you cannot make deductions from these taxes.

Pre Tax Deductions — What They Are & Making Them Work for You

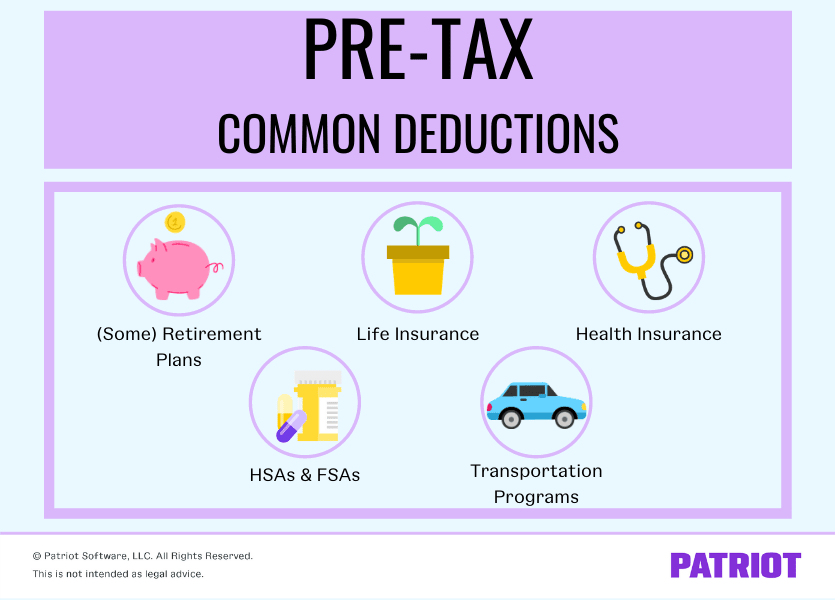

Deductions allow you to put pre-tax money towards benefits for your health and future. These deductions reduce your income taxes and allow you to put your pre-tax dollars to work for you, which you would otherwise lose out on. Though you may have to work with your employer to opt into these benefits.

They fall into three groups:

- Retirement Savings

- Insurance (Health, Dental, Health Savings Accounts)

- Commuting/Lifestyle Benefits

Retirement Savings (401k)

The 401k is a tax-advantaged retirement account where you can contribute up to $19,500 in pre-tax dollars per year. Your contributions today decrease your tax bill, but your withdrawals will be taxed in the future. You can begin taking withdrawals at 59 ½ years old.

Employers usually offer this account with a matching option if you contribute a certain amount. The standard advice is to contribute enough to maximize the employer match. Otherwise, you leave free money on the table.

A preset portion of your pre-tax money is set aside for your 401k and invested in each paycheck. Let’s see an example from my paycheck below.

But how much does a dollar to your 401k reduce your tax bill?

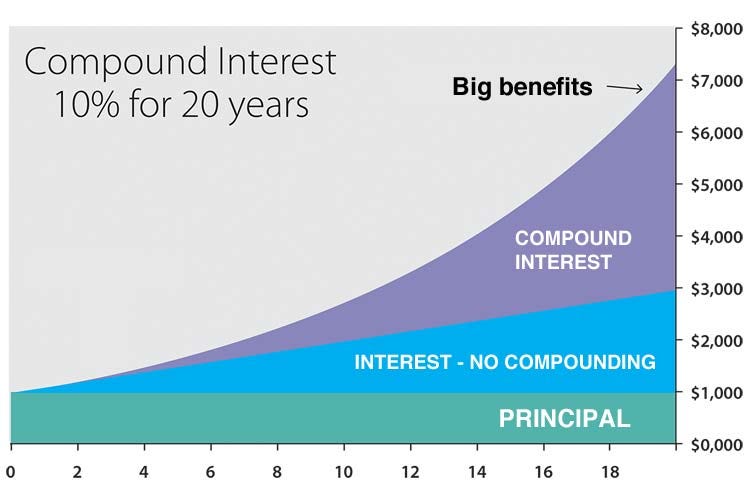

It depends on your federal marginal tax rates. Using the above example of making $50,000, your federal marginal tax rate is 22%. For every $1 you put into your 401k, you save 22 cents in federal tax. That tax saving goes towards your retirement investing and your future self. Every $1 you put aside today is a small step towards making your future self’s life easier. According to Personal Capital, the average 401k balance at 65 is $570,083 — a large chunk of change for your retirement. Also, as your taxable income decreases your state tax bill will decrease too!

Thinking About Your Marignal Tax Rate

If you expect to have a lower marginal tax rate at retirement, then it makes sense to make pre-tax contributions consistently. Otherwise, having a 401k is still a smart choice though the amount you contribute may vary.

The 401k is one of the best deductions you can take advantage of — putting money that would be lost to work for your future! But, unfortunately, 20% of workers with access to a 401k plan do not contribute enough to receive their employer match, whether they choose not to or are not aware of the option. Though it may not seem like much, these contributions add up and compound over time — let alone the sense of comfort and security they create in a person’s golden years.

Insurances (Health, Dental, & Health Savings Accounts)

Insurance helps cover the costs associated with maintaining your health, such as visiting the doctor, prescription medication, and routine dental appointments. In fact, several US states mandate having health insurance, or else you have to pay a tax penalty. Not having health insurance can save you money in the short run, but the medical expenses of an emergency or regular doctor’s appointments can quickly outweigh any costs savings. As someone who uses health insurance, I have it to lower my current costs and cover any future incidents. Note that not all health and dental insurance policies are created equally, so it’s best to read into each plan and pick the ones that best fit your personal needs.

Dental insurance lowers the cost of routine dental appointments, such as teeth cleaning and cavity fillings. Our teeth are irreplaceable and regular cleanings will help maintain their health, making the insurance costs well worth it.

Health and dental insurances can be partially employer-sponsored – which partly offset their costs, depending on the company.

The HSA’s Little-Known Secret – The Triple Tax Advantage

If you select a health insurance plan with a high deductible (the amount you pay out of pocket before insurance coverage kicks in), then you become eligible for an HSA (Health Savings Account). With an HSA, you can save pre-tax dollars to pay for qualified health expenses like copayments, prescriptions, and approved health-related products. You can contribute up to $3,550 as an individual and $7,100 as a family.

Once you have $1,000 in the account, you can invest in the market. The HSA is triple-tax advantaged, as described below:

- Contribute to the HSA with pre-tax dollars.

- Invest HSA contributions into the stock market, where it grows tax-free once you have $1,000 in contributions.

- Spend tax-free on eligible health expenses.

Your HSA will stay with you even if you change your insurance plan in the future. It’s also useful to build up savings for medical expenses in retirement.

If your plan doesn’t allow you to have an HSA, you can open up a Flexible Spending Account or FSA. It’s like an HSA — you can spend it on the same expenses, but it does not come with the triple-tax advantage.

FSA funds only last for a year in which you make your contributions, so it’s best to budget what your anticipated expenses are when you set it up each year. You can spend leftover dollars on HSA/FSA stores on Amazon or other sites. As of 2021, you can contribute a max of $2,750 to an FSA.

In this sample paycheck below, you can see what it looks like with all the before-tax deductions put together.

Commuter Benefits

Your commute to and from work is an expense you usually bear yourself — both in money and time.

As a fresh consultant in the Bay Area, I commuted between San Francisco and South Bay each day. My lengthy commute consisted of walking, riding the train, and taking the bus for about 3–4 hours each day. Using my tax deduction from WageWorks helped offset the train and bus expenses and put money back into my pocket.

Commuter benefits are my favorite set of deductions as they offset my transit expenses (one of my largest expenses) when I did the most commuting. Beyond the 401k, I recommend looking into your employer’s benefits to see if this is an option for you.

Lastly, if you want to calculate how taxes and certain deductions will affect your post-tax pay, use this calculator. I like to model how paying different amounts for a certain deduction will affect my compensation and budget planning and think you’ll find it useful too.

My answer to ‘what is pre-tax income?’ helped me save both in the present and for the future.

The Bottom Line

What is pre-tax income? We learned it’s your gross pay before taxes and deductions and that some of these funds could be left on the table – not working for you. Then, examining each tax deduction in-depth explained how each one works and its value to you. Between covering your retirement, health, and commuting needs, these deductions work for you by providing resources for your health and well-being while reducing your everyday expenses.

What you get out of your money is often up to how much you know. We hope after reading this article, you’ve learned a few ways to take advantage of your pre-tax dollars to better work for your personal situation.