As of January 2020, the average Millennial had 17 paid media and entertainment subscriptions, while the average Gen Zer had 14 (according to Statistica). With the explosion of subscription services, ranging from video games to streaming services to productivity tools, there are no shortages of options to choose from.

Signing up for a free trial allows us to sift through the endless services available and pick ones that provide value to us. But, if we are not sure about the service, we may not want to provide our credit card information to do a free trial. In my own experience, there have been many times where I was in the process of signing up for a free trial and then stopped after realizing I needed to put a card down. Sometimes, it was because my card was not in immediate reach. Other times, I felt it was not worth the effort to add my credit card details.

In any case, there are several reasons why someone might not want to provide their credit card info for a free trial. Let’s dive in and learn: is it illegal to use a fake credit card for free trials?

Key Takeaways

- Most companies require credit info for their free trials to increase conversion rates of potential customers to paying customers.

- Using a fake credit card for a financial transaction is illegal in the U.S.

- An alternative to using a fake credit card is to use a virtual credit card. It is linked to your actual credit card account but uses fake data to make the transaction.

- If you do end up using a real credit card, most companies allow you to remove your credit card data immediately after you start the trial. If not, you can email them to request this change.

Why Free Trials Require Credit Card Information

There are several benefits to requiring credit card info for free trials from a company’s perspective. The rationale is that once you have added your card details, you are less likely to cancel your subscription after the trial ends. On the flip side, if you got asked to provide your details after the trial ends, you are less likely to do so because it requires positive action from you.

Vet Potential Customers

As companies start shifting to subscription services models, competition is ramping up quickly. For example, in the digital streaming space alone, Netflix faces strong competition from Apple TV+, Disney+, Amazon Prime, HBO, etc. With growth prospects commonly used to measure success, driving subscriptions is key to continued expansion and growth.

By prompting users to put down their credit card details when they sign up for a free trial, companies can use that as a signal to identify serious, potential customers. If a customer does not want to put their details down, they were probably a freeloader or less likely to convert to a paying customer anyway.

Ask for Forgiveness, Not Permission

If the subscription service has a low monthly or annual cost, people are more likely to continue paying or even forget to cancel it. The point of a free trial is to get you hooked with the service and choose to continue your subscription. Having your credit card on file makes it more likely for the company to get money from you. If you like the service and choose to keep it, great – the company has gained a new customer. If you cancel the service, the company does not lose much. But, in most cases, that is less likely to happen.

Most people forget when to cancel, especially if the trial lasts more than a few days. Some people may contact customer support to cancel the service after the first charge, but the company will still get a month of fees from you unless you take time to dispute the charge. Or, if the service costs only a few bucks, you might not even notice. Now, the company has a customer that does not even know they are paying for the service. Regardless of whether the customer is using the service or not, the company is making money.

When I first signed up for Amazon Prime as a student a few years ago, I used the free trial for a few months to test the service out. As my semester got busier, I completely forgot my trial period ended and found out months later that I got charged for an annual subscription. At that point, it was not worth the effort to cancel my subscription because such a long period of time had passed already and it would’ve been hard to argue for a refund.

In most scenarios, locking you in early on gives companies a higher chance of converting you to a paying customer.

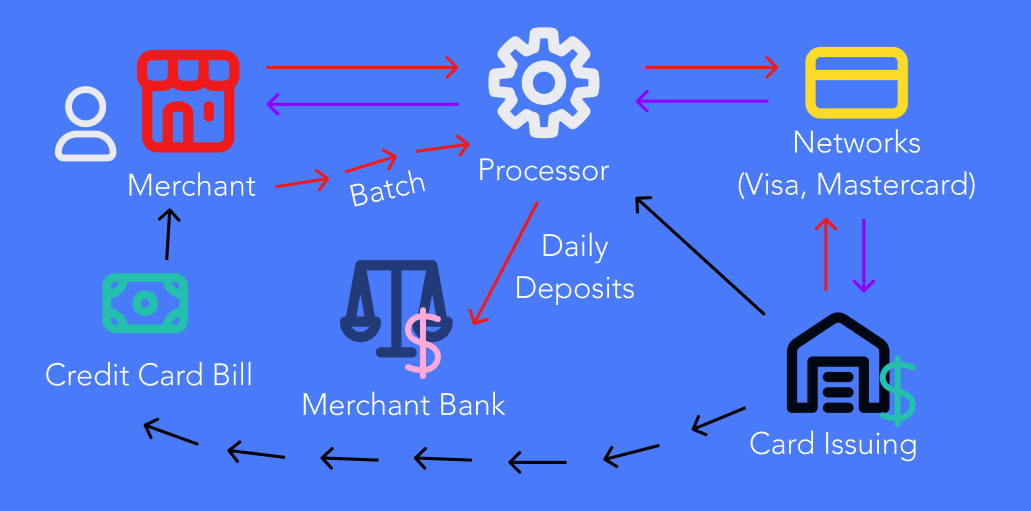

Understanding How Credit Cards Work

When you use a credit card to pay for a good or service, your card details get sent to the merchant’s bank. The bank then gets authorization from a payment card network processor, such as Visa or Mastercard. Once they get authorized, your card issuer will verify your info, including whether the card number is linked to an active account and your name and billing address, to approve or decline the transaction.

If your transaction gets approved, the merchant receives your payment, and your credit card’s available credit gets reduced by the transaction amount. At the end of the billing cycle, you will need to pay off your bill by the due date or risk accruing debt at a high-interest rate.

Before using a credit card, we recommend understanding its benefits and costs and looking for cards with cashback rewards to maximize your returns.

Using a Fake Credit Card For Free Trials

Now that we have provided some context, let’s go over what you came here for – using a fake credit card for free trials.

Fake Credit Cards are Completely Illegal

When you use a fake credit card, you are committing credit card fraud – it is illegal! Even if the card gets declined, you could still get in trouble with the law for intent to defraud in many jurisdictions.

From a company standpoint, they expect a certain number of people to convert to paying customers. That is why companies are offering “free trust” in the form of free trials. If they felt this strategy was not cost-effective, they would not offer free trials to potential customers.

How Fake Credit Cards Work

If you enter a fake number for an online purchase, it probably will not work due to the transaction verification process we mentioned earlier. A fake number is likely to get rejected immediately either because it lacks sufficient funds, or fails the validation checks in place.

Most websites these days have built-in functionality to perform basic validations on credit card info. Sometimes, sites will also initiate a temporary hold on your card to confirm that your card is valid and active. For example, you may have seen companies charge your card $1 or even $0.01 to verify your account. In the scenario where you do manage to enter a fake card number successfully, once a payment request gets initiated after your trial ends, your subscription may get turned off immediately.

Fake Credit Card Generators

You can use a website such as Fake Card Generator to generate completely free unique random numbers linked to real card accounts for temporary use. But, most of these sites state that they are for e-commerce testing purposes only and will typically only be valid for one or two purchases. They likely will not work at a physical store, and some online stores might not accept them.

The Alternative: Virtual Credit Card

If you have concerns over security or privacy, you can use a virtual credit card or prepaid gift card to sign up for free trials or make online purchases. Virtual credit cards are unique, randomly generated credit card numbers linked to your actual bank account, but contain fake credit card info. You can use them to make transactions without revealing any of your real banking info. Similar to a burner phone, think of virtual credit cards as burner cards for one-time usage.

Most virtual credit cards give you the option to easily lock and unlock your cards, as well as set maximum charge limits, giving you complete control and protection. Before signing up for a virtual card, make sure to do some research to find a vendor you trust and is completely reliable.

One of the benefits of using a virtual credit card is that you can sign up for a free trial, such as a streaming service, without worrying that you will get charged afterward when the free trial period ends. Because the vendor will not have access to your actual bank account, they cannot automatically charge you.

Physical Credit Cards vs. Virtual Credit Cards

Physical credit cards are a form of payment that can get used both online and in-store. While they have become more secure with the introduction of radio frequency identification (RFID) technology, you still face risks of getting identifying info stolen if a merchant, such as Target, gets hacked.

Virtual cards are very similar to physical credit cards, as they include a 16 digit card number, expiration date, and security code. However, a virtual credit card allows you to make more secure online payments by adding an additional layer of security to your account.

Because virtual cards are typically limited to a specific transaction, merchant, or spending limit, it is harder for fraudsters to abuse your card. Thus, you can feel more confident to pay online or sign up for a free trial.

Are Virtual Credit Cards Legal?

Virtual credit cards are perfectly legal and available today for mainstream use. Major credit card companies, such as American Express, Capital One, Mastercard, and Visa, issue virtual credit cards to customers for additional security for online purchases.

Additionally, they have virtual credit card generators that can get used for credit card verification purposes, such as free trials. However, these are meant for testing purposes, not for paying for goods or services. If you tend to forget to cancel subscriptions or do not want to pay fees, VCC generators are a great option.

DoNotPay’s Virtual Free Trial Card

DoNotPay’s Free Trial Card is a popular option if you do not want to search for online credit card generators or put in real card info for free trials. A few advantages of the card are that it is easily accessible, protects you from automated subscriptions, and does not link back to your funds.

When using the Free Trial Card, you can use any address or name you’d like, and a virtual card number and expiration date will get provided for you. Additionally, with the DoNotPay app, you can use a temporary email address to sign up for free trials. The temporary email address is then forwarded directly to your real email, but the tracking info will get removed so companies cannot place you on email marketing lists.

A Fun Option: Prepaid Gift Cards

If you have any prepaid gift cards on hand, whether from rebates, attending webinars or from family and friends, you can use them to sign up for free trials. As long as the card has not expired, you should be able to enter the prepaid card information like a credit card. Most places simply want to verify that the card you are entering is valid, so this is a great way to use debit cards that may have limited or no balance on them. Note that some merchants will do a pending hold on the card. So, depending on the amount of the pending charge, there is a chance that this process may not work.

Get Rid of Unwanted Subscriptions

If all this seems like a hassle to you, we recommend being more selective with the types of subscription services you sign up for. Over the past year, I discovered a few subscription services I was interested in, ranging from Japanese snacks box, Bokksu, to sustainable fashion subscription box, Frank and Oak, to gift box, Smoko. However, after doing some cost-benefit analysis, I realized I did not need these services, so I decided not to sign up.

Look through all your bank statements to find existing subscriptions. For each subscription service, decide whether you should keep it or not based on the value it provides you. If you notice a charge for a service that you do not use or do not find valuable, cancel it. If you have family or close friends using similar services, consider sharing subscription services to lower costs, such as Spotify’s Premium Family or Netflix’s Premium Plan.

The Bottom Line

While it is not the end of the world if you try to use a fake card for free trials, it is considered credit card fraud. If you have concerns about your info getting leaked, consider using virtual credit cards instead. If money is an issue, be more proactive in tracking your free trials and subscriptions.

Thanks for this! I didn’t realize the difference between virtual and “fake” cards.

Definitely looking into using a VCC for online stuff.