Refinancing your student loans can save you thousands of dollars over the life of your balance and make it much easier for you to repay your debt. If you have already refinanced your student loans once, you may be wondering if you can do it again to save even more money.

The short answer is that you can refinance your student loans as many times as you want. Since refinancing typically does not carry any origination fees or additional costs, you can significantly reduce your monthly payments and pay off your debt faster by finding a lower rate. However, whether you should be refinancing your student loans multiple times is a different story. Before you refinance your debt again, let’s take a look at the advantages and disadvantages of this strategy.

Key Takeaways

- When you refinance your student loans, you will work with a private refinancing lender to take out a new loan for your existing student loans.

- There are no limitations to how often you refinance student loans. You can work with the same lender or multiple lenders, depending on what works best for you.

- One of the main benefits of refinancing is to get lower interest rates, which will help you save money and pay off your debt faster if done strategically.

- Generally, you should avoid extending the life of your repayment terms and paying extra fees, such as origination fees, application fees, and prepayment fees.

- We will outline an 8-step guide to help you find the best rates and terms for your financial situation.

How Refinancing Your Student Loans Work

To refinance your student loans, you will need to work with a private refinancing lender to take out a new loan for the amount of some or all of your existing federal or private student loans. This new loan usually has different conditions than your previous loans, including the loan terms and interest rate. If you have federal student loans, the tradeoff is that you will need to forego any borrower benefits you have during repayments, such as loan forgiveness or an income-driven repayment plan.

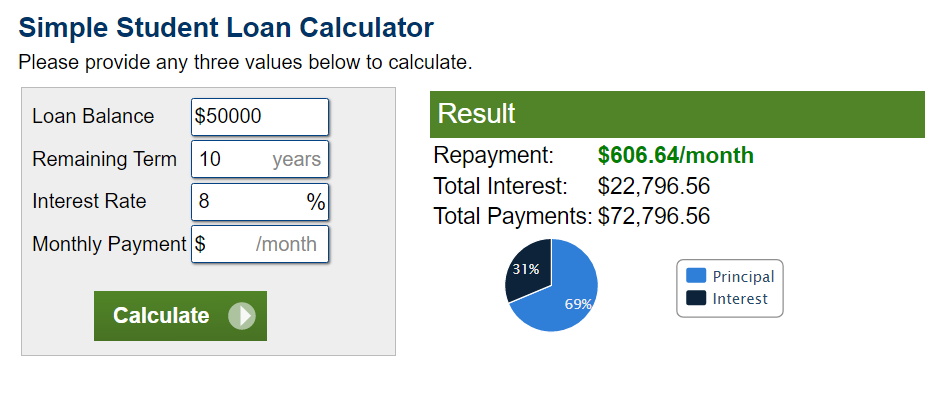

For example, let’s say you have $50,000 in student loans at 8% interest with ten years left to repay your debt. If we use a simple student loan calculator to calculate the balance, your estimated repayment would be $606.64 per month, with $22,796.56 in interest for a total payment of $72,796.65.

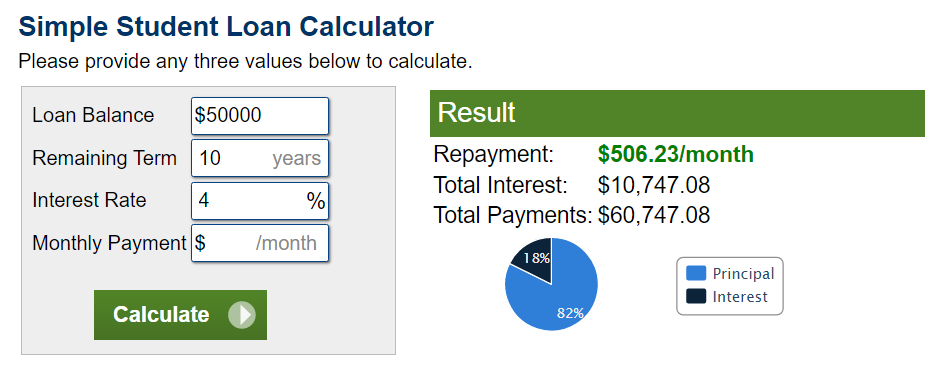

If you refinanced and qualified for a 10-year loan at 4% interest, you would save more than $10,000 over the length of your repayment period. That is a huge difference!

Student Loan Refinancing vs. Consolidation

Note that refinancing your student loans and consolidation are two different processes. When you refinance with a private lender, you effectively combine all your loans into one loan with new terms. On the other hand, a Direct Consolidation Loan allows you to combine multiple federal loans into one loan at a new interest rate based on the average rates on all the loans.

How Often Can You Refinance Student Loans?

You can refinance your student loans as many times as you’d like with your current lender or other private lenders to find better rates. There are no limits as long as you meet the lender’s refinancing requirements, such as having good credit and a steady income stream. Refinancing is usually free and many lenders do not charge application or origination fees.

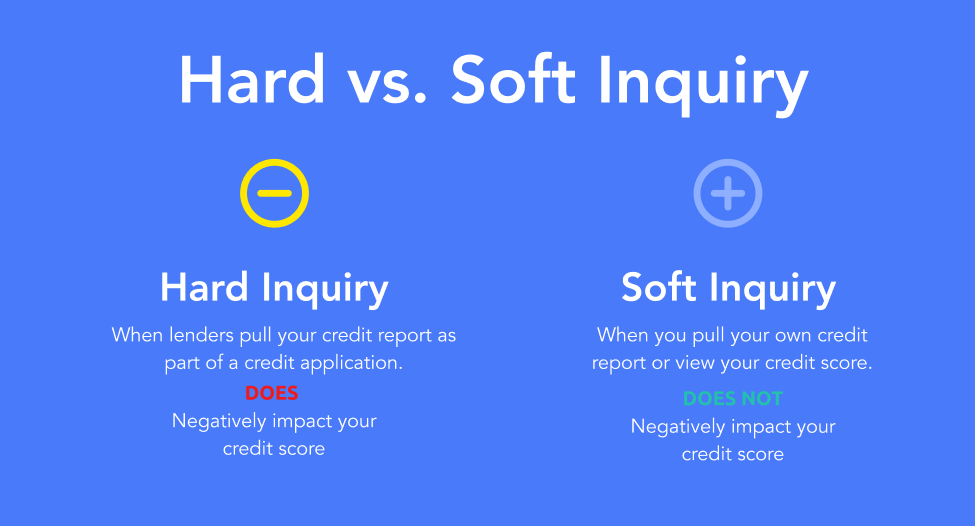

But, consider the long-term benefits before refinancing. Refinancing too often can hurt your credit because you will need to submit a new application each time, which will require a hard inquiry.

Student Loan Refinance With One Lender

If you prefer your current lender, you can refinance with them multiple times. Depending on how long your lender makes their offer available, you are usually limited to one application per month or quarter. Most lenders will leave an offer available for 30 days. Other than this limitation, you can refinance whenever your financial circumstances are favorable since that will help you qualify for lower rates.

Another common reason for refinancing with the same lender is to add or release a co-signer. For example, if you needed your parents to co-sign your previous loan, you may want to release them from the loan once you have a high enough salary to pay it off on your own. Some lenders will not allow married couples to combine student loan debts so adding your partner as a co-signer is the workaround.

Student Loan Refinance With Multiple Lenders

If you want to be strategic, your best bet is to shop around to find the lowest interest rates and best promotions. Many lenders offer a cash bonus to customers who refinance with them, while others may have bonus codes or referral programs.

Strategic Churning

Similar to credit card churning, where you apply for various credit cards over months or years to collect welcome bonuses, you can do the same with your student loans. Private lenders usually offer hundreds of dollars in cash bonuses to new customers who refinance student loans with them. With this strategy, you would be moving your debt from one lender to the next to collect a cash bonus each time you refinance. But, keep in mind that interest rates may vary. Calculate the cost of the new interest charges compared to the cashback bonus before you make the switch.

Simultaneous Applications

Shopping around with multiple refinance lenders will help you comparison shop and negotiate lower rates. When you receive an offer, you should contact a representative, who will likely negotiate the final terms with you. While some lenders will not negotiate, you can go through online-only lenders to find the best rates.

Why You Should Refinance Student Loans Multiple Times

The main advantage of refinancing several times is getting a lower interest rate to pay off your debt faster and save more money over time. Alternatively, you can refinance for a longer term with smaller monthly payments to have extra cash flow. You may end up paying more interest over time, but you will be in a better position to accomplish any short-term or medium-term financial goals.

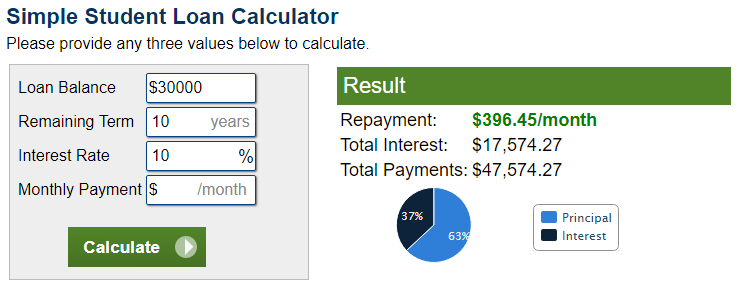

For example, let’s say you graduated with $30,000 of private loan debt at a 10% interest rate. You would pay roughly $396.45 per month for ten years and pay $17,574.24 in interest by the end of the repayment period.

If you refinance to an interest rate of 7.5%, you could end up paying about $40 less per month and $5,000 less in interest over ten years. As you build your credit and grow your income, you may eventually qualify for even better rates, which will lower your total interest charges, monthly payments, and the repayment period.

Downsides to Student Loan Refinancing

Refinancing your student loans multiple times can help you save money and get more manageable monthly payments. But, as mentioned earlier, if you have any federal loans, you will lose access to loan forgiveness programs and income-driven repayment plans.

Additionally, with each loan application, lenders will pull a hard inquiry on your credit, which can lower your credit score by up to five points. While one inquiry is nothing to sweat about, multiple inquiries in a short time is a different story. Though the decrease is temporary and tiny, refinancing too frequently can cause a substantial drop in your credit.

If you are shopping around for better rates, limit your shopping to a smaller window of time to avoid your credit getting dinged more than necessary. Usually, you will have up to 45 days to look around. Alternatively, you can try prequalifying with different lenders before officially applying, as that will not impact your credit score but still give you enough information about your available rates.

Another factor to consider is how much time you have. Nothing is stopping you from refinancing your debt several times, but you should do your due diligence to make sure it’s worth the effort. Research reputable lenders and their rates and terms to ensure that the benefits are advantageous.

By itself, refinancing student loans are not bad. However, it may or may not be a good idea depending on your financial situation. If you are struggling with poor credit or are currently unemployed, now may not be the best time to refinance.

Note that the White House has approved more than 16 million people for federal student loan forgiveness as of January 27, 2023. While this program is still being contested, If you want to refinance but have federal student loans, it may be worth waiting to see what happens next. That way, you give yourself time to reassess your financial situation and for the government to provide better guidance on the loan repayment process.

What You Need to Know Before Refinancing Multiple Times

While you can refinance your student loans multiple times, that doesn’t mean you should refinance them every month. A good refinancing benchmark is once every two years, or at minimum, one year. A hard inquiry will not affect your credit anymore after one year and will fall off your report in two years.

Although there are scenarios in which refinancing is beneficial, there are times when it may cause more harm than good. Below are loan terms that may not be helpful for you.

Refinancing can extend your repayment period. So, it is crucial to understand your total monthly payment and interest over time. While you will have a smaller monthly payment if you have a longer repayment term, you may also end up paying more in interest. On the contrary, with a shorter payment period, you will need to make higher monthly payments, but you will pay less interest down the line. Depending on your financial situation, it may make sense to lower your monthly payment, but keep the additional interest charges in mind.

Some lenders might not offer a lower interest rate when you refinance. You should choose the lowest rate possible and aim for interest rates below 10%. When looking for new loans, you will generally encounter two types of loans: fixed-rate and variable interest rate loans. You will have the same interest rate for the entire repayment period with fixed-rate loans. While they may be higher than the initial rates variable rate loans offer, they are easier to plan around because the rate will not change.

On the other hand, variable rate loans have interest rates that change depending on the rate or index they get tied to. The longer your repayment period, the more your rate may climb, which could leave you with more interest charges than expected. If the loan is short-term, variable rate loans may be more appealing, but if the loan is long-term, you may be better off with fixed-rate loans.

Some private lenders charge high origination fees, while others don’t charge any at all. Origination fees get used to cover the cost of processing a new loan, including underwriting, checking your credit, and verifying and processing your documents. Before you refinance with a lender, compare the fees to avoid adding more debt to your existing balance.

While prepayment fees are illegal for student loans, some lenders may take advantage of you by sneaking in unfavorable conditions. Regulations require all student loan lenders to allow penalty-free prepayment, so if a lender charges you for paying off your student loans early, you should consider changing lenders as soon as possible.

Usually, student loan lenders will not charge application fees for submitting your loan application. If your lender requires an upfront, non-refundable fee, make sure you qualify for the loan since you would have wasted money if it gets denied.

When refinancing, look for lenders that do not charge excessive fees but still offer you competitive loan terms. By understanding the different types of fees and terms, you can identify red flags early on and find the best refinancing options for your financial situation.

When to Refinance Your Student Loans

Unless you get a lower interest rate, there may not be much reason to refinance. The rate you get will be based on several factors, including your income, credit score, and current market rates.

Lenders base the interest rate they offer you on your perceived risk level for repayment. That means having more stable financial credentials may help you qualify for more favorable terms. If you have gotten a new job with a much higher salary since you first signed on for your current loan, you may be a good candidate for lower rates.

Having a good debt-to-income ratio may also help your application. If you have increased your income or have paid off other debts recently, you likely improved your debt-to-income ratio (DTI). Or, if you have raised your credit score recently, your application may be more attractive to lenders. If you and your partner are a dual-income household, it may make sense to refinance student loans together to use the power of two incomes to your advantage.

If you have a strong financial situation, refinancing can help you lower your monthly payments and allow you to have more disposable income to pay off other debts or financial obligations. Whether you have refinanced before or this is your first time, make sure to check your new loan term to see if it benefits you.

Additionally, keep an eye on the federal interest rate. It may become cheaper to borrow money when the Federal Reserve lowers short-term interest rates since private lenders usually follow the Fed. Note that this does not apply to recent federal loans that Congress sets once a year since 2006.

If you are juggling multiple payments and lenders and find it impossible to keep track of everything, you may want to refinance to consolidate your debt. That way, you can streamline your repayment process with one monthly payment instead of several different ones. However, this should not be the main reason you consolidate your loans. Make sure you score better terms as well.

8-Step Guide to Refinancing Your Student Loans Again

Before you refinance your loans again, here are some things you should keep in mind.

1. Understand Your Financial Goals

Think about your financial goals. What do you hope to accomplish by refinancing your student loans? Do you want lower monthly payments to give yourself room to achieve short-term goals, such as tackling credit card debt or repairing your car? Do you want peace of mind by paying off your debt as soon as possible?

Once you have a clear picture of what you want to do, you can better understand the best options to help you achieve your goals. Without defined financial goals, it may be harder to pick the right choice for you.

2. Check Your Credit Report

Before you refinance again, you should confirm that your credit is in good standing or has improved since you last refinanced. You can get a free copy of your credit report at AnnualCreditReport.com and check your credit either with your financial institution or a third-party platform like Credit Karma. Currently, I check my FICO score every month through my banks to ensure there are no major fluctuations or unexpected changes. I also have notification alerts set on Credit Karma to monitor my credit and any suspicious activity.

If you have been making regular, on-time payments for your bills and have paid down some of your debt, you are more likely to qualify for better rates. Different refinancing lenders may have their own credit requirements but aim to have a credit score of 650 or above.

3. Think About Your Finances

Each lender will have its own income requirements. Before refinancing, check your debt-to-income ratio. To get more favorable terms, it should be less than 50%. You can calculate your DTI by adding up your total monthly payments from all your debts, including credit card debt, auto loans, mortgages, etc., and dividing that number by your monthly income.

For example, let’s say every month you have:

- $2,000 in credit card debt,

- $500 in auto loan payments,

- $500 in student loans payments,

- $5,000 income.

Based on the numbers,

($2,000 + $500 + $500) / $5,000,

your DTI is 60%. Because this number is over 50%, you may need to pay off all your credit card debt before you can qualify for better terms.

Additionally, you should gather all your personal and financial information. That includes having your pay stubs, tax returns, home address, and Social Security number ready when you want to refinance.

4. Check Your Rates

Refinancing multiple times does not mean you will get lower rates each time. There are limits to how low your rate can go. Before applying for a new loan, review your current interest rates and use a site like Credible to compare prequalified rates online from different lenders. That way, you have a good idea of what rates you qualify for before submitting any applications.

If you have absolutely no idea where to look, SoFi, Laurel Road, and Earnest are good starts. These companies make up roughly half of the refinancing market. Once you have done your research and crunched the numbers, you can be more confident you are getting favorable rates and terms.

5. Compare Student Loan Refinancing Offers

When you prequalify for loans, the lenders will pull a soft inquiry on your credit. Unlike a hard inquiry, a soft pull will not impact your credit. Based on the information they get, lenders will confirm your likelihood of getting approved for the loan and provide an estimate of your potential rates and terms.

As you evaluate different offers, compare the interest rates, interest rate types, loan terms, forbearance options, and co-signer release policies. Depending on the length of repayment, fixed or variable rates may have different effects on your terms.

Private lenders are not required to offer the same benefits that federal loans provide, such as payment-reduction options or income-based repayment terms, so check each lender’s payment plan and forbearance policies carefully.

If you need a co-signer, make sure you understand the co-signer release requirements. When you ask someone to co-sign for you, they are putting their credit on the line on your behalf. So, try to look for lenders who have more favorable release policies, such as allowing borrowers to release their co-signer after a certain number of regular, on-time payments.

6. Avoid Extending the Life of Your Loan

Avoid new loans that will extend your repayment period if possible. For example, let’s say you have a 10-year repayment term from your initial student loans. You have already been paying for two years, so you only have eight years left before you are debt-free.

If you refinance and choose another ten-year term, you would effectively be adding another two years to the life of your loans. That means you will be in debt longer and probably have to make more interest over time even if the interest rate is lower. In this situation, refinancing will hurt your financial situation rather than help you save money or decrease your debt load. If saving money is your main goal, make sure you fully understand the new terms and how they will affect your existing debt.

7. Read the Terms and Conditions

Some lenders will secretly add on additional fees, such as prepayment penalties or origination fees, on your terms and conditions. You have a legal right to pay off your loans early, so confirm your lenders do not charge any unnecessary fees that end up costing you in the long run.

8. Weigh the Costs and Benefits

Always weigh the benefits and costs of student loan refinancing carefully. If you sign without fully understanding what you are getting yourself into, you could end up extending your repayment term, paying more interest, and racking up unnecessary fees. Like with any contract you sign, read the fine print.

The Bottom Line

The goal with refinancing student loans strategically is to enhance your financial position. While there are no restrictions to how often you can refinance student loans, always do your research and pay attention to the finer details. That way, you can spot potential red flags early on and save yourself headaches down the line. Even if you are not in the market for refinancing right now, it’s a good idea to keep this option open as a possibility in the future.