Want to make investing easy, but don’t have the time to analyze hundreds of stocks?

Then, mutual funds are for you.

They are fund offerings that invest in a wide selection of assets like stocks and bonds and are a core part of any long-term portfolio.

Using mutual funds in your investment strategy can be a great asset to simplify your investing process, diversify your portfolio, and get back more of your most precious asset — time. Let’s dive in and learn about the advantages of using a mutual fund and answer your question: how many mutual funds should I have?

Key Takeaways

- Mutual funds are best suited for long-term investments such as retirement or child college savings.

- Different fund types have different advantages but equity funds are the core of any strategy due to their high risk/reward profile.

- The magic number of funds depends on your strategy and investment objective.

What’s the Deal with Diversification?

The most surefire way to reduce risk while playing the markets is through diversification.

I learned about diversification in my first econ class. My professor summed it up as not putting all your eggs in one basket. This ties into the two forms of risk.

In the stock market, these are the main forms of risk:

- Firm Risk – the risk of a specific company stock not performing well or failing

- Market Risk – The risk of participating in the markets (e.g. recession, natural disaster)

The mutual fund was his main example of diversification because a fund spreads your money out into up to dozens of investments – diluting away any specific firm risk and leaving you only with the market risk or systematic risk. Thus, individual investors expect to earn the market’s overall return or to meet the market – with the right fund. Famed investor, Warren Buffett considers it foolish when investors, professional or otherwise, claim they can beat the market’s long-term performance.

The S&P 500 Connection

When people in the finance industry refer to the “market” and its performance as a benchmark, they often mean the S&P 500 index and its average annual real return of 8%. This is partly due to the S&P 500 index resembling a well-diversified equity portfolio in its makeup of the top 500 firms from all sectors of the American economy. My favorite exchange-traded fund (ETF), VOO, is based on the S&P 500 and I include it in all my long-term portfolios.

Other Types of Risks

Here are a few common risk types.

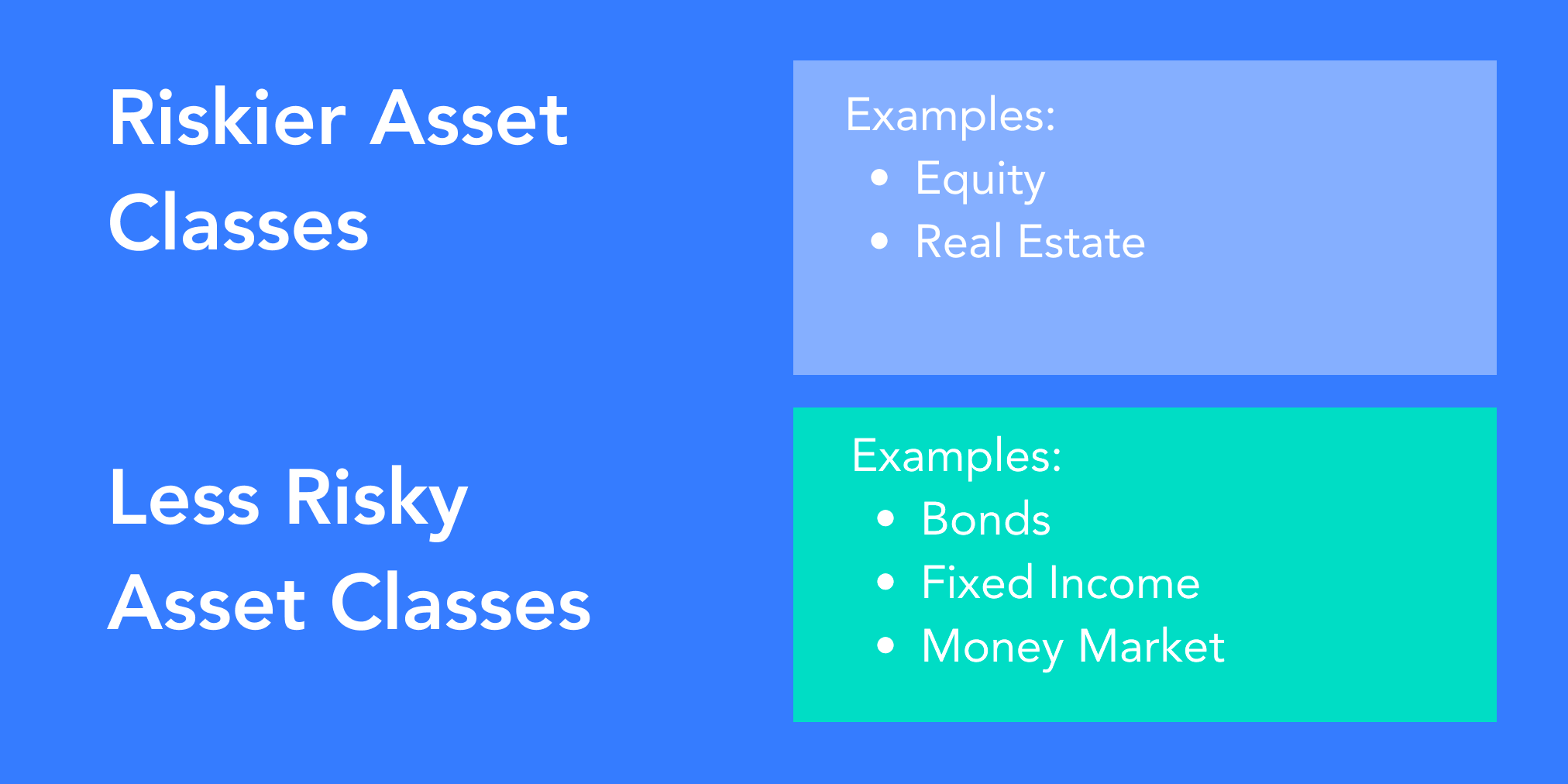

- Sector risk – Investing too heavily in one sector like tech or utilities means if market conditions are not favorable the investor will get lose out on more than they would if diversified. When US interest rates rose, Tesla and Amazon fell in price as the tech sector thrives off of low-interest rates.

- Concentration risk – When one asset class is overrepresented in a portfolio, its success is tied to it. If an investor is 100% in stocks and the market has a downturn, they will not be able to balance it out with other assets like commodities or bonds.

- Foreign Investment (Geographic) risk – If an investor holds too many assets in their home market or if they invest in another country where the business environment differs. Investors in firms like Alibaba accept the possibility that the Chinese regulators may suddenly scrutinize the firm or issue a new rule that affects the company’s operations.

All of these risks can be mitigated through a diversified portfolio. But it begs the question…

How Many Mutual Funds Should I Have?

Despite what financial media may say, there is no magic number of funds to hold in your portfolio. Consider that most funds hold over 100 securities each and that financial advisors claim a diversified set of 20-30 stocks is enough. Too many funds will dilute your return potential. What’s in each fund matters, not how many funds you have.

The ideal number of mutual funds depends on your investment style and risk tolerance. Most investors opt for a “set it and forget it” approach with one of these four mutual fund portfolio strategies.

Single Fund – One Fund For Everything

Allocation: total market fund

Holding just one fund like a total market index fund can leave you well off. This approach is also called buying the index, where you buy into one diversified market index and a piece of all the small-cap, mid-cap, and large-cap equities in it.

Example

Two Funds – 60/40 Split

Allocation: total market and domestic bond fund

Adding in a domestic bond fund reduces volatility’s effects on your portfolio as bonds are less volatile than stocks. Bonds move against stocks, especially in a downturn. This means your portfolio has less volatility for your portfolio as bonds tend to fluctuate less and move opposite against stocks in a downturn.

Adding in a domestic bond fund reduces the effects of volatility on your portfolio as bonds are more stable and move opposite of stocks. In a downturn, bonds can act as a counterweight and preserve your portfolio – making this strategy suited for a more risk-averse investor. A common allocation is 60% equities and 40% bonds.

Example

Three Fund Portfolio

Allocation: 2 funds + international market fund

A well-known approach for early investors, this strategy is a low-cost approach to build a solid portfolio for life. It diversifies your holdings across asset classes and internationally, so you can capture growth opportunities abroad (e.g. Tencent, Alibaba) and weatherize your holdings.

Example

Four Fund Portfolio

Allocation: 3 funds + international bond fund (or other option)

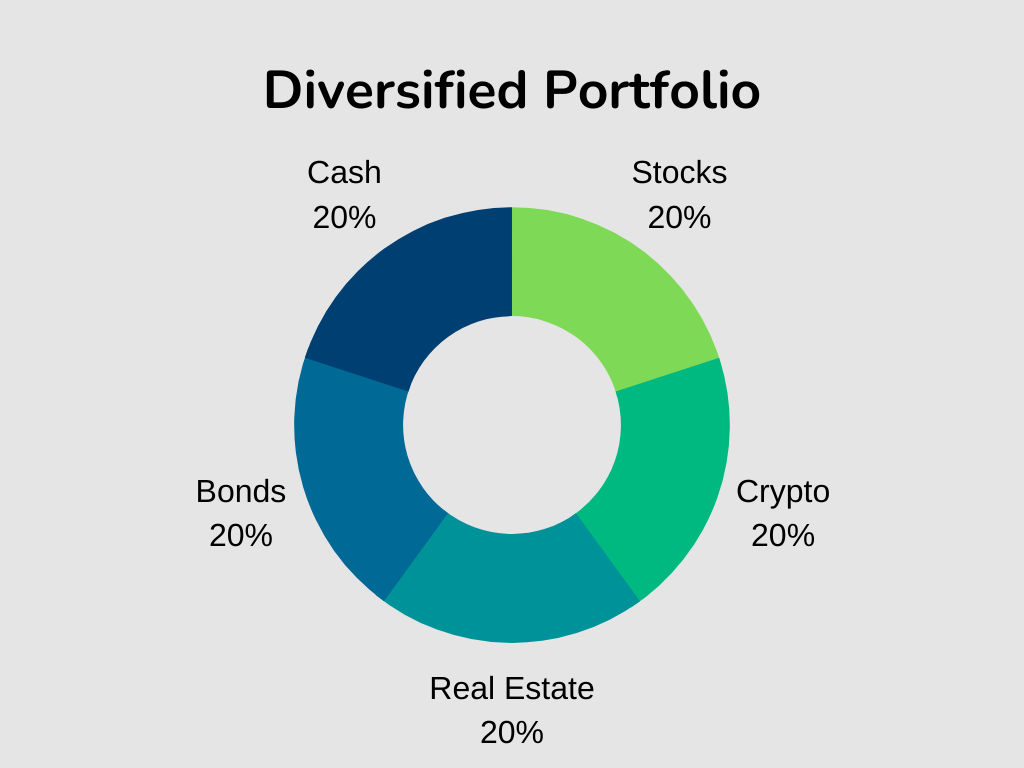

If you want to diversify your holdings, then you can take the three fund portfolio and add in another asset class or international bond fund. Holding other assets like crypto or real estate stabilizes your holdings while presenting

Depending on your choice of fund and how many you have it becomes harder to manage your portfolio. A simple allocation of 25% into each fund or asset will work (e.g. two bonds funds and two stock funds).

Example

VTSAX, VBTLX, VTIAX, IAU (Gold Fund)

VTSAX, VBTLX, VTIAX, Cryptocurrency (e,g. Bitcoin, Ethereum)

Now, let’s explore the different types of funds in-depth.

Overview of Fund Types

There are a lot of fund types out there. Here are some of the most common, including several types of equity funds.

1) Target Date Fund

This fund type auto-adjusts its holdings as you age to optimize your return while managing your risk. They tend to invest in different funds, including the types covered below.

You select a fund based on the year you anticipate to retire (e.g. 2060) and the fund changes its underlying holdings to match the risk level of an investor at a given age. If you are in your 20s, your fund will be more weighted in equities and will increase the portion of bonds as time goes on.

As a younger person, you take on more risk for higher returns. Several Millennial-aged investors I know have target-date funds in their portfolios because each fund offers automatic rebalancing of its asset allocation.

2) Small Cap Stock Fund

Small caps are companies whose market capitalizations are between $300 million and $2 billion. These stocks are more volatile than their higher market cap counterparts as the firms are younger, high-growth companies susceptible to economic pressures. If the Fed changes interest rates, it will affect growth forecasts and investor expectations drastically.

A small-cap fund can beat the market as the underlying firms have the potential to soar in bull markets. Examples include Entegris Inc, Molina Healthcare, Marathon Oil, and Signature Bank.

3) Large Cap Stock Fund

This type of fund is made up of companies with market capitalizations greater than $10 billion each. Large firms (e.g. Apple, Microsoft) make up~ 98% of the total US equities market and are significant global brands. As these companies are mature, they will have less growth potential. This fund type is a core portfolio holding due to its stability and dividend generation. Many S&P 500 names are in this type of mutual fund.

4) Mid-Cap Fund

Mid-cap companies are those firms with a value between $2 and $10 billion. Companies in this range include famous names like Chewy Inc, Dropbox, Dominos Pizza, and Palantir. They are included in the S&P 500 and Russell 1000 stock indices. Mid-caps hit a sweet spot balancing risk and return as they have more stability than small caps while offering higher growth potential than large caps. Squarely in the center of the risk/return range, mid-cap funds round out one’s holdings. Holding a mix of small-, mid-, and large-cap funds will balance out and diversify your portfolio.

5) Sector Fund

A sector fund (aka specialty fund) focuses on a specific industry or niche like sustainability, tech, or specifically semiconductor firms. This fund type is highly targeted and only carries companies within that focus, creating a high risk profile. An investor using a sector fund uses it as part of a targeted strategy but should invest in broad market mutual funds to balance out their risk. These funds are susceptible to sector-specific risks, so it helps to be well-researched in the market environment of that sector and monitor the market’s movements.

6) Growth Fund

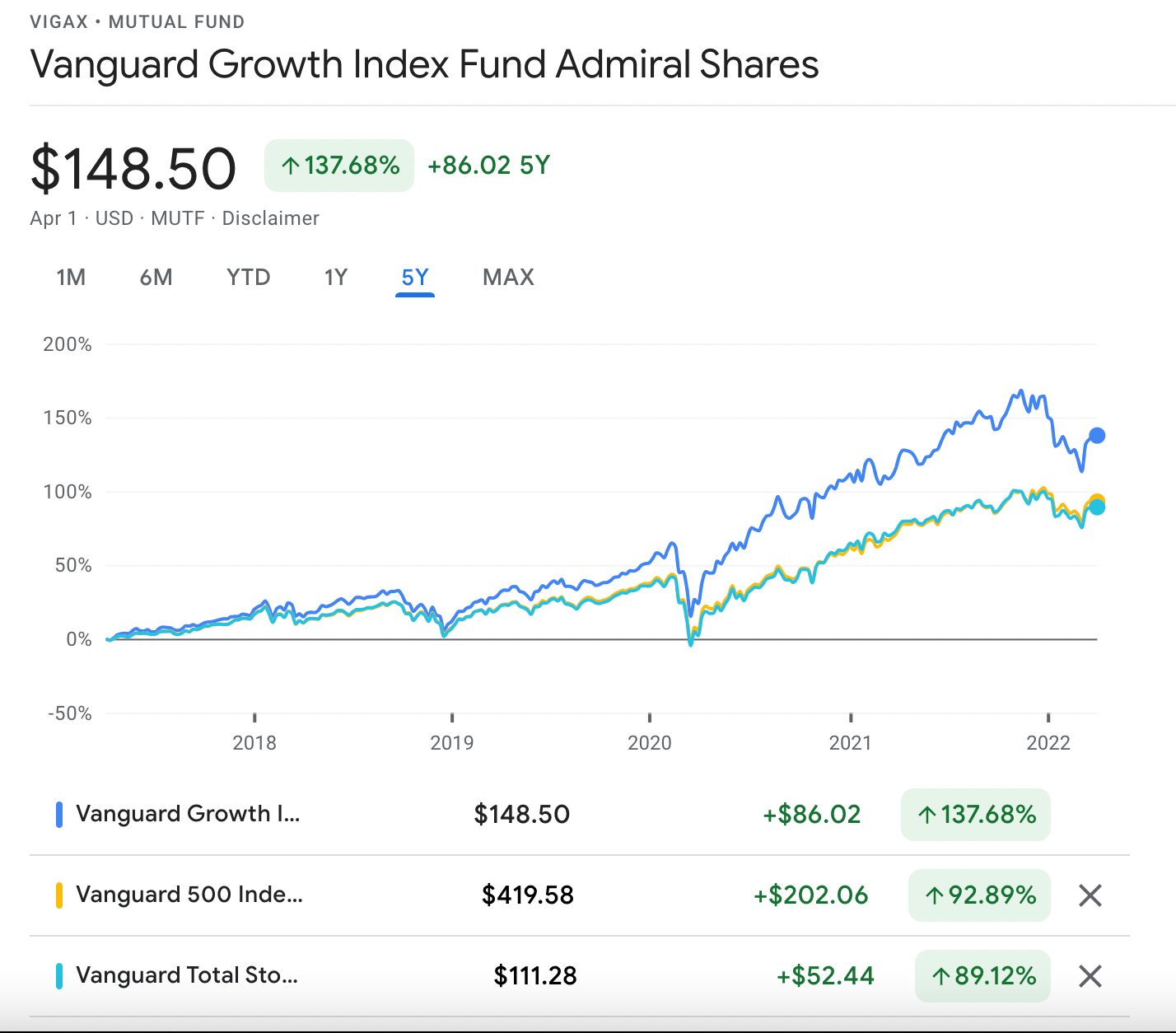

A growth fund is a mutual fund that holds firms with high-growth potential (e.g. Tesla). This fund type has little to no dividend yield, as growth firms reinvest their profits to expand their businesses. These funds are best suited for growth investors, who are willing to bet on high yields in the future. They use varied strategies but many will contain familiar names like Apple, Tesla, or Amazon. They can also hold the names of smaller-sized but well-known firms as these funds employ strategies of market cap and sector funds. In fact, two popular funds VTSAX and VIGAX contain the same FAANGM companies in their top 10 holdings.

I used to hold both VTSAX, a total stock market fund, and VIGAX, a large-cap growth fund. VIGAX focuses on large firms with the potential to grow faster than the market average. Looking at a comparison of each fund’s past performance we see that VIGAX outperforms.

As a proxy for the S&P 500’s performance, you can see that VFIAX (S&P 500 Index Fund) closely tracks VTSAX – but both are surpassed by VIGAX. Note that these three funds have similar holdings, like many mutual funds in this niche.

Like other young investors, I favor growth funds due to high risk/reward profile. Investors early in their journeys should consider using this fund type.

7) Debt Fund

Debt funds come in many forms, but let’s focus on bond funds. This fund type invests in either one type of bond or a mix of them (municipal, corporate, government) to produce monthly income for fundholders. The exact payout varies as the fund’s makeup changes.

This fund type is a great way to diversify into another asset class as bond prices move against interest rates (e.g. if interest rates go down, then bond prices go up) and stock movements. Buying into a bond fund eases the process of buying and selling them. As an asset class, bonds are more favored by older investors who desire wealth preservation and hold less volatile assets.

8) International Fund

This fund type invests in assets outside of the investor’s home country, usually in foreign companies (e.g. Latin America mining firms). They are intended to diversify an investor’s assets away from a home country bias, country-specific, and foreign exchange risks. Common examples include emerging markets, sector-specific, and foreign bonds. Some risks include market transparency, political events, lower liquidity, and transaction costs.

The Bottom Line

We’ve explored the key advantages of mutual funds and the different types of investment risk. We also dove into the different types of funds and various investing strategies that use 1-4 funds. The number you need depends on your investment objective, timeline, and strategy. Equity funds provide the best risk/return profile due to their level of risk and shareholder pressures to deliver on growth.

No matter which fund you look at it’s important to understand the underlying securities within it and to spread risk around to solidify your holdings. For more specific guidance on mutual funds, it’s best to seek out investment advice from an advisor.

Bonus FAQ Info

Q: What are the different types of mutual funds?

- Money market funds – the safest type of fund that centers on short-term investments made by US firms, state/local governments, and the federal government. A money market fund is often used as an alternative to a savings account due to the more competitive interest rates, but it’s very similar to staying in cash.

- Fixed income funds (aka bond funds) – generating income via dividend yield on US company, state/local government, and federal government debt.

Q: Is there a firm that offers mutual funds with low expenses?

- Vanguard, founded by Jack Bogle, is well-known for its low-expense fee funds and is preferred by many investors.