In our lifetimes, the concept of money is undergoing disruption. There are alternatives to participating in the government-backed, fiat money system that has held sway for decades. Now, other options compete to be your money of choice – fiat vs crypto.

Cryptocurrency

Starting with bitcoin, the last 10 years have seen a rise of over 4,000 blockchain-based cryptocurrencies. Some will try to replace fiat currencies or disrupt existing industries, while others are meant for laughs (e.g., Dogecoin). Cryptocurrencies are a new type of digital currency based on blockchain technology that maintains a record of transactions. The transparency of the blockchain ledger, use of cryptography, and distributed computing ensure secure processing over the network and check the influence of any single operator on the transaction record. It’s the focus on creating a secure, trustless system that makes blockchain technology appealing for currencies.

However, the extreme price swings make cryptocurrencies unpredictable and not reliable as a medium of exchange. Many advocates of cryptocurrencies claim this is to be expected at the early adopter phase of new technology. Plus, you must have an internet connection to use them.

Fiat Currency

Fiat translates to let it be done, reflecting how governments create money by decree and authority. For most of human history, governments wholly owned the power to create and manage currencies. In a fiat system, the government can make any item that can be used as a medium of exchange a currency, including paper bills, seashells, or tulips. Governments create and maintain their currency systems through central banks like the Federal Reserve in the US.

Fiat monies are not backed by assets or precious metals like gold or silver, so they cannot be converted into those assets. During the 1970s, the world’s governments moved away from the gold standard to fiat systems. In the US, the government made this move to protect American gold reserves from the excess demand to convert dollars into gold from foreign trading partners with large dollar reserves.

Today, fiat currencies exist as coins or paper currencies like the US dollar, British pound, Japanese yen, etc., which are not backed by gold, silver, or any precious metal. This means these currencies have no intrinsic value, except for that which the government gives them. As fiat currencies are in the form of paper cash, they are the most commonly used on a day-to-day basis.

Let’s dive in to see how fiat currencies and cryptocurrencies compare and differ. But first, let’s talk about the three qualities of a currency.

3 Qualities of A Currency

Unit of Account

A currency must denote value between goods and services through pricing that reflects their relative values. For example, the retail price of my car was $30,000 and provides me with more value than the $5 vanilla latte I got from a Starbucks down the street. A currency should also be divisible into smaller portions.

Central banks use monetary policies to maintain the value of their currencies to other currencies and goods and services. They print money or adjust interest rates to achieve their desired currency valuation. A dollar, for example, can be broken up into smaller units such as nickels, quarters, and dimes.

Cryptocurrency supplies are usually fixed, and the value of a unit of a given crypto is fluid – depending on market prices. A cryptocurrency like bitcoin is divisible into smaller units called satoshis, with 100,000,000 satoshis making up one bitcoin. Transactions can be conducted in small satoshi amounts, though the gas fee to do the transaction may outweigh the value of it.

Fiat Currencies & Unit of Accounts

Around the world, people relate the value of a product or service in their local fiat currency. Even cryptocurrency prices are commonly expressed in fiat terms like the US dollar. It’s more understandable to say something costs $X dollars or €Y euros rather than 0.001 bitcoin or 100,000 satoshis. People grow up in cultures where fiat money is used and form and express their perceptions of value in those terms. Fiat currency has a special sort of mental monopoly on how people think of and express value.

Store of Value

Any currency must be able to maintain its value for there to be widespread confidence in it. The money you have today should have the same value tomorrow, indicating its stability and reliable nature. If someone says they will pay you $500 in 1 week, you want to make sure it has the same value when you get paid. If a currency’s value fluctuates wildly, it could tank, and people holding it would be left holding far less than what they originally had.

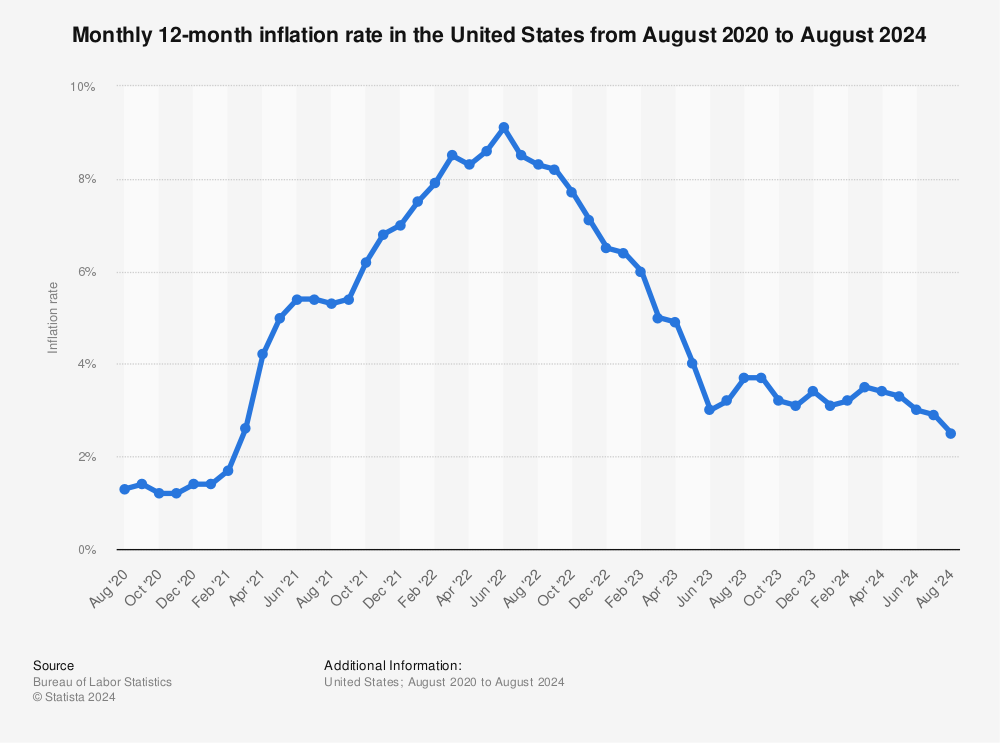

Fiat currencies are generally stable but are subject to inflation in the long term. Inflation at a low rate (e.g., the 2-3% rate target of the Federal Reserve) is healthy for an economy. More importantly, it sets stable expectations for how the currency’s value will trend over time. Wage increases usually compensate for healthy long-term inflation, so the populace earns more of the currency. The fact that the US dollar is used in global trade and held in reserve by other central banks makes it the world’s reserve currency. In essence, the global financial system is based upon the US dollar, making it difficult to replace or reduce demand for it.

The value of fiat currencies can change rapidly due to changes in central bank monetary policy, such as the Federal Reserve printing $3.8 trillion dollars to help combat the economic effects of the pandemic, which has increased the money supply to its largest size ever. This has affected inflation, as shown below.

The spike in inflation has been concerning for investors and makes them want to find other places, such as cryptocurrencies, to store their funds.

Cryptocurrencies are highly volatile, with the leading currency, bitcoin, having peaked at $65,000 per coin and falling to $30,000 in the space of a month. Cryptocurrencies are a new technology and early in their development hence the extreme volatility. But it is this volatility that means they do not retain their value and prohibits their use in more mainstream life.

The use of stablecoins, cryptocurrencies tied to an underlying asset like the USD or gold, has made them more reliable as stores of value. Stablecoins exhibit much less price volatility than their assetless counterparts. However, many investors value the scarcity and computing work that go into cryptos like bitcoin, believing these aspects will drive value up over time.

Medium of Exchange

A population must accept the currency as a valid form of payment. Buyers and sellers must agree to use it as a form of payment. For instance, if you offered to buy your Starbucks with tulips, the store would likely turn you down as they don’t see it as having any value. Nevertheless, due to the stability of fiat mentioned above, it is still the most favored currency for exchanges.

Since its inception over 10 years ago, cryptocurrency has become increasingly mainstream and is now more accessible than ever before. Cash App, Venmo, and other payment services now offer the ability for users to trade, send, and receive popular cryptocurrencies. Credit card networks such as Visa and Mastercard are finding ways to conduct crypto transactions over their networks. At this fast pace, cryptocurrency could be more mainstream in the near future – that is, if its value fluctuations become less extreme. Using cryptocurrency depends on a reliable internet connection, which may not be available everywhere – limiting its reach. For these reasons, fiat currencies will likely prevail as the preferred medium of exchange.

Fiat Money & Cryptocurrency Comparison

Similarities

- Crypto, like fiat, is a medium of exchange and store of value, though crypto is less accepted and more volatile. However, the upward trend of the crypto market makes it attractive to invest in as an appreciating store of value, rather than fiat currencies which lose value through inflation.

- Both types of currencies have no intrinsic value as they are not backed by hard assets like silver or gold. Instead, their value is derived from widespread acceptance. The exceptions are stablecoins like PAXG, which is backed by gold, or by GUSD or USDC, which are backed by their own US dollar reserves.

- Both types of currencies exist largely in the digital realm. For cryptocurrencies, they exist entirely in blockchain networks, while traditional fiat currencies only have about 8% of their total circulating supplies as physical cash, according to Forbes. In fact, over 90% of the US money supply only exists digitally. At this point, the US dollar could be accepted as a digital currency that can be redeemed for a paper representation.

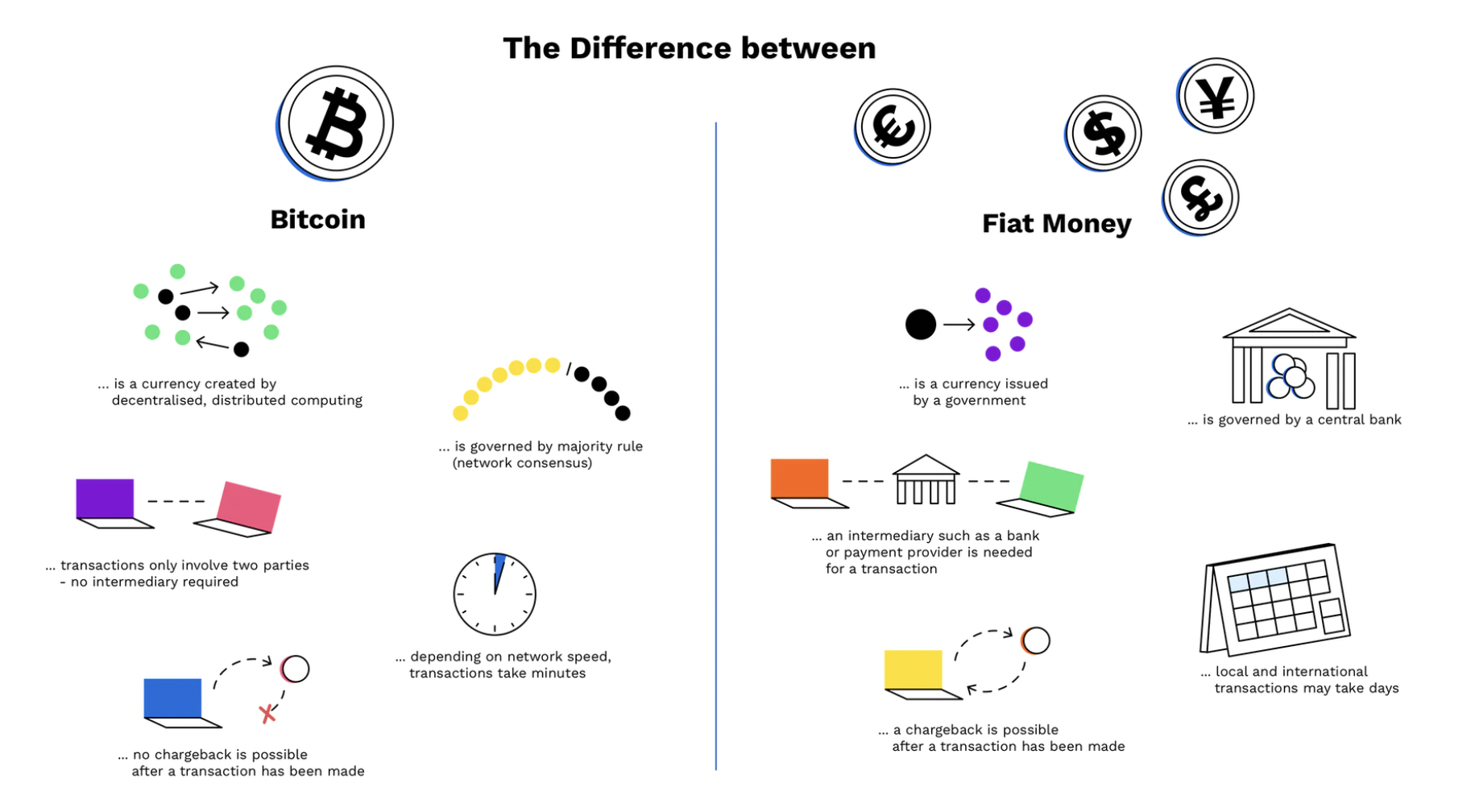

Differences

- Digital currencies are treated as property for federal tax purposes, so any buy, sell, or conversion activities are considered taxable events. Even using cryptocurrency to buy something is a taxable event.

- Cryptocurrencies are not legal tender as they are not issued by a central bank and are regulated by algorithms. The government controls fiat money supplies.

- Cryptos are controlled in decentralized systems, unlike fiat monies. This setup protects the value of cryptocurrencies and removes the need for third parties like banks to process transactions.

- Fiat currencies are created from debt as the government takes loans out and creates money when people or banks take those loans. If there were no loans taken out, then there wouldn’t be any of that fiat currency in circulation. Conversely, cryptocurrencies are created through the computing work that goes on operating a crypto’s blockchain network.

- The use of blockchain technologies secures transactions and ensures they are permanent and transparent to all network users. This security and transparency create confidence in the networks. Otherwise, fiat currency transactions are reversible and are not transparent to the general public in a central record system.

- The transaction throughput of a cryptocurrency like Bitcoin or Ethereum is only a portion of fiat centralized networks. The decentralized nature of blockchain networks is to blame as duplicative computing work is done on different systems, then reconciled. In fact, there is a major issue called the Bitcoin scalability problem, which highlights the limits of crypto networks when it comes to processing large amounts of transactions in short periods of time.

This scalability issue makes cryptos more viable as stores of value rather than mediums of exchange. For comparison, Visa and Mastercard networks respectively claim they process 1,700 and 5,000 transactions per second, though Visa claims they can scale up to 24,000 transactions per second. The Bitcoin network can process 7 transactions per second at best, while Ethereum handles up to 45 transactions per second. Ethereum’s network throughput cannot match its demand, which leaves its users with high transaction fees and wait times.

- Cryptocurrencies can easily be sent around the world. All the sender has to do is specify the recipient’s address, pay the network transaction fee, and click send. Most transactions are conducted in seconds to a few minutes. Fiat money transactions are highly regulated and involve several intermediaries – taking several days to process and settle. Sending money across country borders incurs larger fees and takes several days, making them more costly than crypto.

Which Will Win

While fiat currencies are entrenched in our way of life, cryptocurrencies and their maturing ecosystem provide an alternative. Time will tell if key roadblocks such as limited transaction throughputs, price volatility, and government regulation will be overcome for mainstream acceptance. The advantages of the independent, decentralized nature of cryptocurrencies are how we think of and use money. They are here to stay as the world becomes increasingly skeptical of institutions and the underlying technology improves.

For investors, cryptocurrencies are better stores of value than fiat currencies. Over the last year, the Federal Reserve has printed money that has devalued the dollar at an unanticipated rate. I invest in crypto and spend in fiat. I invest in cryptocurrencies to bet on the future success of crypto and as a long-term store of value in an appreciating asset class. Otherwise, I use fiat to pay for things in everyday life. I view cryptocurrencies as assets to grow value in and fiat monies as a medium of exchange. Both types of currencies will coexist.

Money will be money. It has taken many forms, from paper notes to tulips, but its role as a unit of account, store of value, and medium of exchange will remain. As technology develops, cryptocurrencies could be the next iteration in humanity’s experiment with money.