Key Takeaways

- Compounding is the effect of asset growth when its earnings are reinvested into the same asset to generate additional returns.

- The exponential growth of compounding drives wealth creation.

- Buying and holding stocks allow investors to have full advantage of the benefits of compounding and maximize the odds of a positive return. Conversely, investors that manage their holdings with shorter-term strategies are less likely to see the returns that compounding can create.

Compound Interest

Famed physicist Albert Einstein once stated, “Compound interest is the eighth wonder of the world. He who understands it earns it…he who doesn’t pays it.” To learn compound interest is to learn the foundation of investing and how to generate compound stock earnings.

Compounding is when an asset’s earnings are put back into the investment to create their own earnings. Earnings come from either capital gains, which are profits from the sale of a stock, or interest.

Compound growth is exponential growth as the initial amount and successively reinvested earnings make their own gains over time. In other words, your prior earnings make future earnings. This effect makes compound growth stronger than only making interest on your principal – which exemplifies linear growth. Compound growth is the single most important financial concept that drives long-term wealth generation. Let’s dive more into how it works.

Compound Stock Earnings-How it Works

P = C (1 + r/n)nt

This is the formula for compound growth. The future value of the investment is determined by the initial principal, the total time the asset is held, the number of times compounding occurs, and the annual rate of return.

Understanding the math behind compound growth is helpful, but let’s bring it closer to the everyday world.

An Example

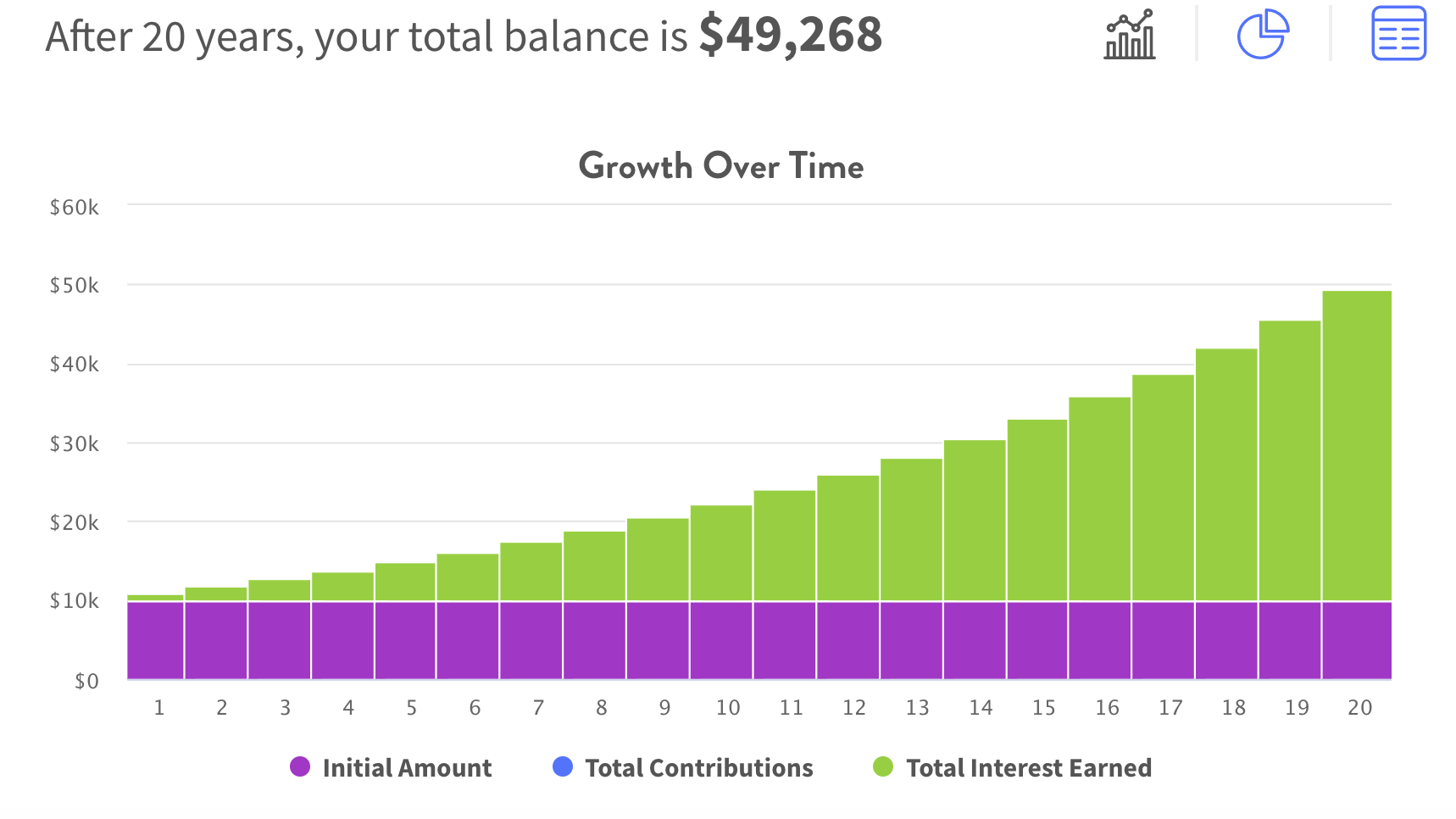

Suppose a person invested $10,000 in an S&P 500 index fund (basket of stocks of the top 500 publicly traded U.S. firms), such as VOO or SPY, in 2000 and held for 20 years, that $10,000 would become $49,270. With an 8% average annualized real rate of return – it’s almost 5x the initial investment.

If you use an index fund, you do not need to search for individual companies to invest in or spend time each year to rebalance your holdings.

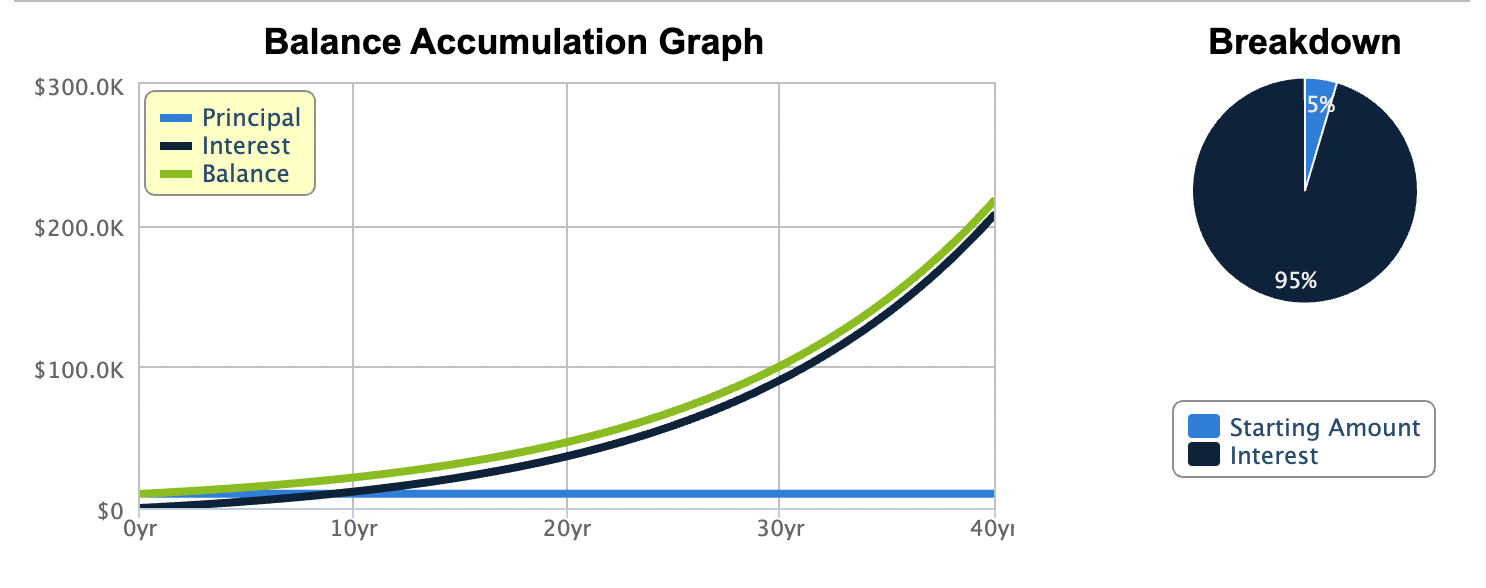

And if you hold for 40 years at the same 8% rate, that $10,000 ends up as $217,250 – almost a 22x return. Note how 95% of the asset’s worth comes from the interest made over time.

An investor experiences the true value of compound growth from holding a reliable asset for decades with a patient mindset.

Why It Matters

Who Benefits from Compounding Earnings

You!

Whether you are a retail or institutional player, anyone invested will benefit. The keys are a long-term mindset, investing in a diversified portfolio, and reinvesting your returns. Usually, retail investors play the markets with long time horizons of 30-40+ years as they invest for retirement – which we cover more below.

Ways to Amp Up the Benefits

Retail investors use compound earnings to build their retirement nest eggs, which are usually held for up to 40 years at a time. Using specific accounts like a 401k or IRA comes with tax advantages that incentivize the average person to become a long-term investor. Below are primers on the benefits of each account.

Retirement Accounts

- 401(k)

- Contribute your pretax money to reduce your taxes now, but your future withdrawals are taxable on their earnings growth.

- Offered through an employer and sometimes comes with an employer-matching option.

- The standard advice is to contribute enough to maximize the employer match.

- Once the contribution vests, you have sole rights to the money.

- Contribute up to $20,500 in 2022

- You are eligible to make withdrawals without any penalties starting at age 59 1/2.

- Can hold assets such as index funds, ETFs, bonds, company stocks, REITs, etc.

- Roth IRA

- Contributions are made after taxes have been paid, and there are no taxes on withdrawals so investment gains are tax-free.

- The account is set up individually and favors people who want more tax-free money in retirement.

- Contribute up to $6,000 in 2022 (if you make less than $139,000).

- You are eligible to take withdrawals without any penalties starting at age 59 1/2.

- Can hold assets such as index funds, ETFs, bonds, company stocks, REITs, etc.

According to the data, these retirement accounts are not utilized as much as they could be:

- As of mid-2020, ICI reports that only 37% of American households have an IRA of some form.

- 79% of Americans have access to a 401(k) but only 41% participate, meaning the rest are not taking advantage of it and are missing out on compounding gains.

Many people miss out on the benefits of these privileged accounts. Unfortunately, many more miss out on the opportunity to invest – due to a lack of financial education or awareness. Opening up one or both of these accounts is a great way to take advantage of compounding gains and build wealth for your future. It’s also easy to diversify your portfolio and create an account with sustainable, long-term growth prospects.

I’ve used a Roth IRA for years. Opening the account early on was a good way to jumpstart my investing journey.

Tips and Tricks

- Pay off your high-interest debt first, as it can quickly pileup as the interest accumulates. It’s tough to beat a 23% APR!

- Contact and work with a financial advisor or coach to help address any financial worries or questions. Even one call with a coach can help you create a general plan to get your financial life planned out.

- Use a compound interest calculator website (like this one) to model out what happens if you buy an asset with specific amounts of initial principal and further contributions.

The Bottom Line

The benefits of compounding put the power to build wealth in your hands through consistent investing. It is possible, if not likely, to become a millionaire investor through long-term investing and a patient mindset.

Living within your means, paying off your debts, making regular contributions, and saving for your future are all good habits that your future self will thank you for doing. If you want to help your future self live a good lifestyle, then start investing when you can with the resources you have available. Invest early and often to watch your wealth grow!