When you apply for a new credit card, credit card companies will ask you a series of questions, including what you do for work and how much you earn annually. After that, they may occasionally request optional income updates. Alternatively, you can update your income whenever there are positive changes.

If you are in the process of applying for a new credit card, you may be wondering if there are any repercussions to lying about your income. Perhaps, your current credit score is subpar, and you want to report a higher income to increase your odds of qualifying for the card. Or, you want a higher credit line than your current income will likely get you. Here’s what can happen if you put the wrong income on your credit card application.

Key Takeaways

- A credit card application is considered a legal document. So, when you put false information on your credit application, you are committing fraud and exposing yourself to the possibility of getting prosecuted.

- Not all lenders will ask for proof of income. But, it is a good idea to provide accurate information.

- If you do not qualify for a traditional credit card because of your credit score or income, you can build credit by applying for secured cards or getting a co-signer.

Is Lying On Your Credit Card Application Considered Fraud?

Yes – lying about your income on a credit card application is considered loan application fraud and can come with hefty penalties, including fines and jail time. When you submit your application for a credit card or other loans, you are signing a legal document, therefore, affirming that all of the information is true.

While it is unlikely that you will get convicted for loan application fraud, there have been cases of people getting prosecuted, such as Solomon Gordon Raymond of San Diego, who was sentenced to almost 5 years in jail and fined $729,192 in restitution.

If you accidentally reported the wrong income by a significant margin, call the issuer to correct it. While most lenders will not verify income for credit card applications, you should still provide accurate information.

Importance of Income on Your Application

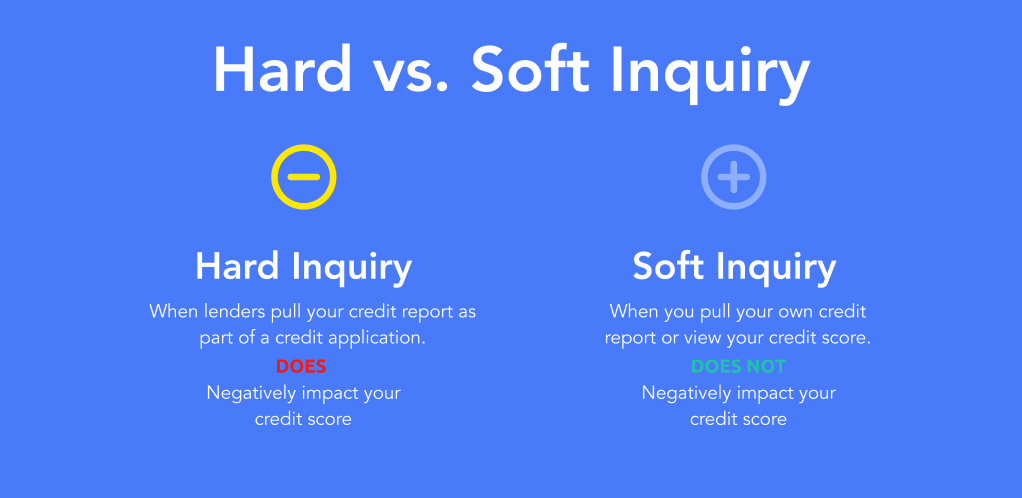

Although most credit card companies will pull a hard inquiry on your credit report to determine your creditworthiness, income plays a significant role. There are legal protections in place today meant to protect consumers like you and me from predatory lending practices, which is why most lenders need to follow income requirements before approving any credit card applications. On the other hand, when you accidentally report the wrong types of income or purposefully lie to qualify for a credit card, the financial institution involved can choose to pursue criminal charges against you.

Lying is Tempting…

When you apply for a credit card, you will usually get asked your name, address, Social Security number, annual income, employment information, debt load, etc. If you put down an income within a reasonable range of your expected pay for the upcoming year, the credit card issuer will generally take your word for it.

Depending on what you put down for your income and employment status, that could impact your approval odds or the credit limit you get. The higher your income is, the more likely your application will get approved with a higher credit line. So, you may get tempted to inflate the numbers in your favor.

Impact of a Higher Credit Limit

There are a couple of reasons why getting a higher limit may be beneficial:

- You can boost your credit score. Your credit utilization, or how much of your credit line you use compared to your total credit limit, makes up a significant factor when calculating your credit score. The lower your credit utilization, the better. Generally, the rule of thumb is to keep your utilization below 30% (i.e. spending $3,000 or less for $10,000 of total credit), which is much easier to do when you have access to more credit.

- You have more spending power. If you have any big-ticket expenses coming up, such as a medical bill or vacation, a higher credit line can help you cover all the costs (though in those cases, you should consider building sinking funds instead).

Do Credit Card Issuers Really Check?

Credit card companies are big businesses and likely receive hundreds of thousands of applications every day, making it difficult to analyze each one carefully. More often than not, they will not put in the time, effort, and cash necessary to verify your information. Realistically, the only time a bank will want solid proof of income is for extremely large loans like mortgages since the stakes are much higher, and they have more to lose.

Can Credit Card Companies Access My Bank Account?

Credit companies may ask you to submit bank statements or pay stubs to prove your income, but they cannot access your bank account information without your permission. Additionally, your credit report will not show how much money you have in your checking or savings account.

But, it does show your credit history, which is a better indicator of your risk as a borrower. If you want to check your data, you can get a free copy of your reports from each of the three main credit bureaus, Equifax, TransUnion, and Experian. As you look over your credit reports, make sure there are no signs of fraud or inaccurate data, such as hard inquiries that should not be there or debt you do not recognize.

Still, you should avoid overstating your income. Many card issuers will randomly ask applicants to provide proof of income during the application process and may reject your application if they find discrepancies.

When I applied for the Chase Freedom Flex credit card, I was in the process of transitioning to a new role and had a much higher projected annual income than what was on the pay stubs I submitted. Because Chase could not verify my stated income, my application got flagged and automatically rejected. I ended up going back and forth with their customer support for a couple of weeks and had to submit a copy of my offer letter to prove that the annual income I submitted was accurate to get the credit card approval.

In other cases, if you fall behind on your payments, the banks may want to check why you got approved for a higher credit limit than you can afford. American Express is known to audit borrowers who set off specific red flags and lock their accounts until they can verify income and other data as needed.

Declaring Bankruptcy

If you max out your credit cards, cannot afford the bills, and want to file bankruptcy to discharge the debts, the banks will come after you to figure out what happened and why they approved your application. At that point, you would need to provide documentation on your income, assets, debts, etc. If they find out you acquired the credit card under false pretenses, you will not be able to discharge your debt.

That is why you should be honest during your application process. Conduct due diligence on the credit cards available in the markets and find one that fits your financial circumstances. For example, if you are struggling to pay off your existing balances, transfer your debt over to a 0% APR credit card and get a side hustle to tackle the debt as soon as possible.

Taking on More Credit Than You Can Handle

Lenders set credit limits for a reason. They have complex processes designed to review and vet applications, which usually involve mathematical formulas, considerable testing, and analysis. So, statistically, the credit limit they give you is how much they think you can reasonably afford and repay promptly.

When you get access to more credit than you can manage, you could put your credit at risk. If you fail to make your payments, your debt might snowball to the point where you will struggle to pull yourself out of that debt. If you put in the correct information, the lenders can limit your risk and its own risk by giving you a manageable credit limit.

The downside of having access to more credit is that you are more likely to overspend if you are not careful. Just because you have more spending power does not mean you should increase your spending to match the credit increase. The last thing you want to do is accumulate too much credit card debt and create unnecessary high-interest debt. If you feel like you need to lie, the loan you want likely does not fit your current budget.

Alternatives to Consider

If you do not think you will qualify for a traditional credit card, you have other legal alternatives available.

Use a Secured Credit Card Instead

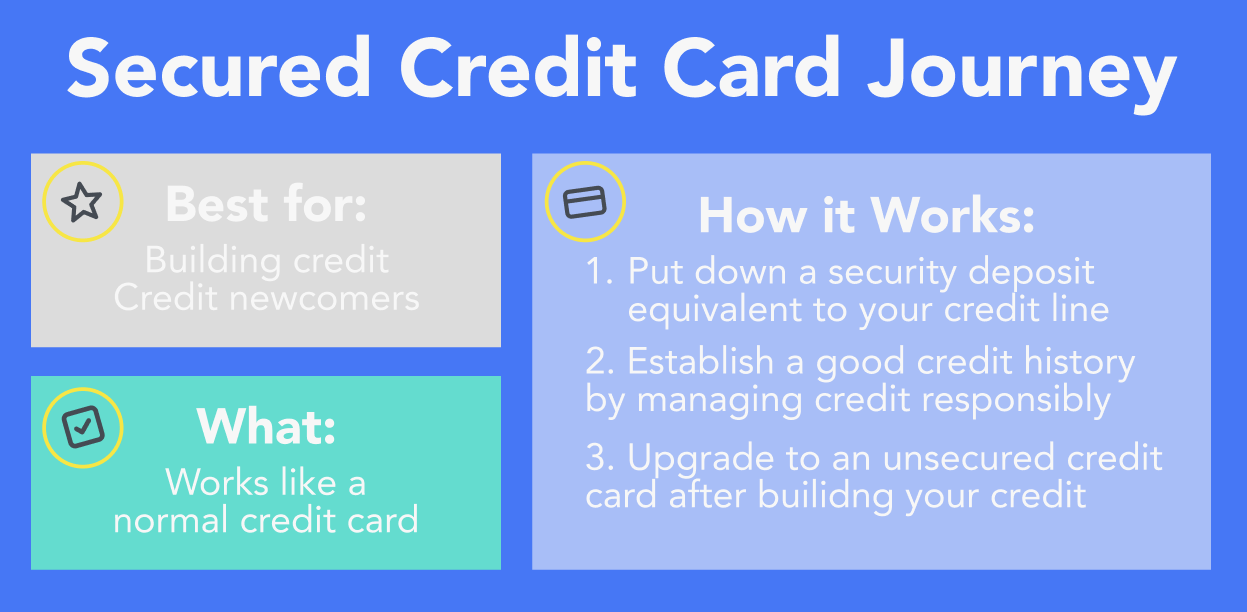

If you have poor credit, you can apply for a secured credit card, which is great for credit newcomers or people trying to rebuild their credit. The way it works is that you would give your lender a security deposit equivalent to your credit limit upfront. For example, if you deposit $500, the bank will send you a credit card with a $500 limit. That way, you provide collateral to the lender, allowing them to take on less risk to approve your application.

Depending on which lender you work with, any activity on the card should get reported to the credit bureaus. Over time, your credit score will gradually improve once you show that you can make on-time payments and manage your debt responsibly.

Like Other Credit Cards

A secured credit card works like any other credit card. You can use it to purchase goods and services, and at the end of the billing cycle, you should repay the debt in full. If you need to carry a balance, at the very least, you should pay off the minimum monthly payment. If you fail to make a payment, your credit will get negatively impacted, and the lender will take money out of your security deposit. If you max out the card and do not pay, they can take your entire deposit.

Once you establish a good credit history, your lender may graduate you to an unsecured card, or traditional credit card. Alternatively, you can apply for an unsecured card with other lenders and close your account. When that happens, you will get your security deposit back.

Upgrade to Unsecured

When you think you have a good shot at qualifying for a traditional credit card, shop around to find one that works best for you. Some credit cards come with hefty annual fees, while others are free. Some offer cashback rewards, while others have travel perks.

Take a look at your current spending and identify which areas you spend the most in, such as restaurants, gas, groceries, etc. Then, find a card that will reward you for spending in those areas. For example, I spend the most on restaurants and entertainment, so I look for cards that reward me for dining out and traveling.

Get a Co-Signer

A co-signer credit card account involves a primary credit holder with a co-signer, such as a family member or close friend, who usually gets added to help them qualify for the loan and build credit. With this type of account, the co-signer is held responsible for any charges on the card and effectively provides the financial backing needed to cover future unpaid debts (if any).

Think of a co-signer as your guarantor – they are typically needed in cases where you cannot qualify for the loan on your own. They will not have access to your funds because they are not an authorized user. But if you miss a payment, both you and your co-signer will get negatively impacted. Vice versa, if you make all your payments on time every month, both of you will benefit.

Be Upfront About Your Credit

If you are asking your partner, a close friend, or someone else you trust to be your co-signer, you need to be honest and transparent with them from the start. Otherwise, you can seriously strain your relationship with them if anything goes wrong.

Be open about your credit scores and history, including why you are asking them to be your co-signer. If they agree, they are putting their credit on the line for you, so you need to give them as much information as possible regarding your finances to help them gauge the risk they are taking.

Discuss Any Debts You Have

Depending on your relationship with your co-signer, you need to let them know if you have any outstanding balances that could impact your ability to pay off your credit card debt. While this may be uncomfortable or embarrassing, taking this step will let you get everything out into the open. Some things you can go over include:

- Total debt from all accounts

- Types of debt (i.e. auto loans, student loans, credit card debt, etc.)

- Individual account and loan balances (i.e. $500 monthly auto payments, $300 monthly student loan payments, etc.)

- Percentage of your income that goes toward repaying your debt every month

- Payment schedules (i.e. when you expect certain debts to get paid off)

Frequently Asked Questions (FAQs)

What are the consequences of lying on a credit card application?

If your profile gets flagged for being “sketchy” for some reason, such as failing to make payments or racking up significant debt, your bank may audit your account. If they discover that you purposely lied about your income, employment status, or other personal details, they could lock your account and choose to prosecute.

Do credit card companies care about how much income I put on my credit application?

Yes, credit card companies care about the income you put on the application. While the credit card company will pull a hard inquiry on your credit, income is a major component of your application getting approved or denied and the credit line they extend to you. If you put an outrageous number, such as one million dollars, when your income is, in fact, $50,000 or less, the credit card company may outright reject your application.

Is income verified when applying for credit cards?

Not all lenders will ask for documentation to verify your reported income. Depending on the credit card you want to apply for, proof of income may not be a requirement for approval.

If you are applying for a credit card with a lender you do not have a relationship with and they cannot verify your salary, they may ask for proof of income in the form of your most recent paystubs. If you are self-employed, they will usually ask for your tax return from the previous year.

If there are major discrepancies in the information reported, lenders may flag your application. For example, if you report $20,000 of income to the IRS and a $100,000 salary on multiple credit card applications, you will likely get caught lying and may get convicted of bank loan application fraud.

Why don’t credit card firms check your income before approving your application?

Because of the sheer volume of credit card applications lenders get every day, it is not worth their time to verify every single application. From a consumer’s perspective, acquiring tax reports, pay stubs, and other documentation is time-consuming. So, people may get discouraged from applying if credit card companies require that data.

Generally, better credit cards in terms of benefits and limitations will require higher credit scores to qualify. As long as you have a solid payment history and no red flags on your credit reports, lenders will assume that you will probably pay all your bills on time and manage your credit responsibly without confirming your income.

Can you put household income on your credit card application?

Yes, if you are 21 or older, you can include your household income, such as income from your spouse or partner, on your credit card application. If you are under 21, you need to show that you have independent income or get a co-signer to qualify for a credit card.

According to the Credit Card Act of 2009, credit card companies must take the consumer’s ability to make on-time payments into account when deciding whether to approve an application or not. A 2013 amendment expanded the definition of consumers’ ability to pay for anyone 21 and older to include any income that they have a “reasonable expectation of access” to. That includes income from a spouse, partner, or someone else in your household, as well as nonwage income, such as savings, trust funds, and unemployment benefits.

Should you update your income with your credit card issuer?

The only time you will be required to provide accurate information on your income is during the application process. Otherwise, you should only update your income if it will benefit you. For example, if your monthly income or annual salary has increased since you applied for your card, you should update your credit card issuer. That way, they can potentially raise your credit line from your initial limit. On the other hand, if you make less money now, it’s best not to report that.

The Bottom Line

The truth is that if you lie on your credit card application, lenders will probably never find out. But, you should avoid doing so because it is a crime and can come with significant fines and jail time if you get caught.

If you do not qualify for a traditional credit card on your own, there are legal alternatives available, such as applying for a secured card or getting a co-signer. These options will also help you build your credit over time and work towards your financial goals.

It is also in your best interest to apply for a credit card that makes sense for your unique financial situation. If you do not know how to handle large credit lines responsibly, then you probably should not apply for them.